Section 174: A Guide on How to Take Advantage of It

The Guide to Reclaiming Your Six-Figure R&D Tax Refund

Pensero

Pensero Marketing

Jan 12, 2026

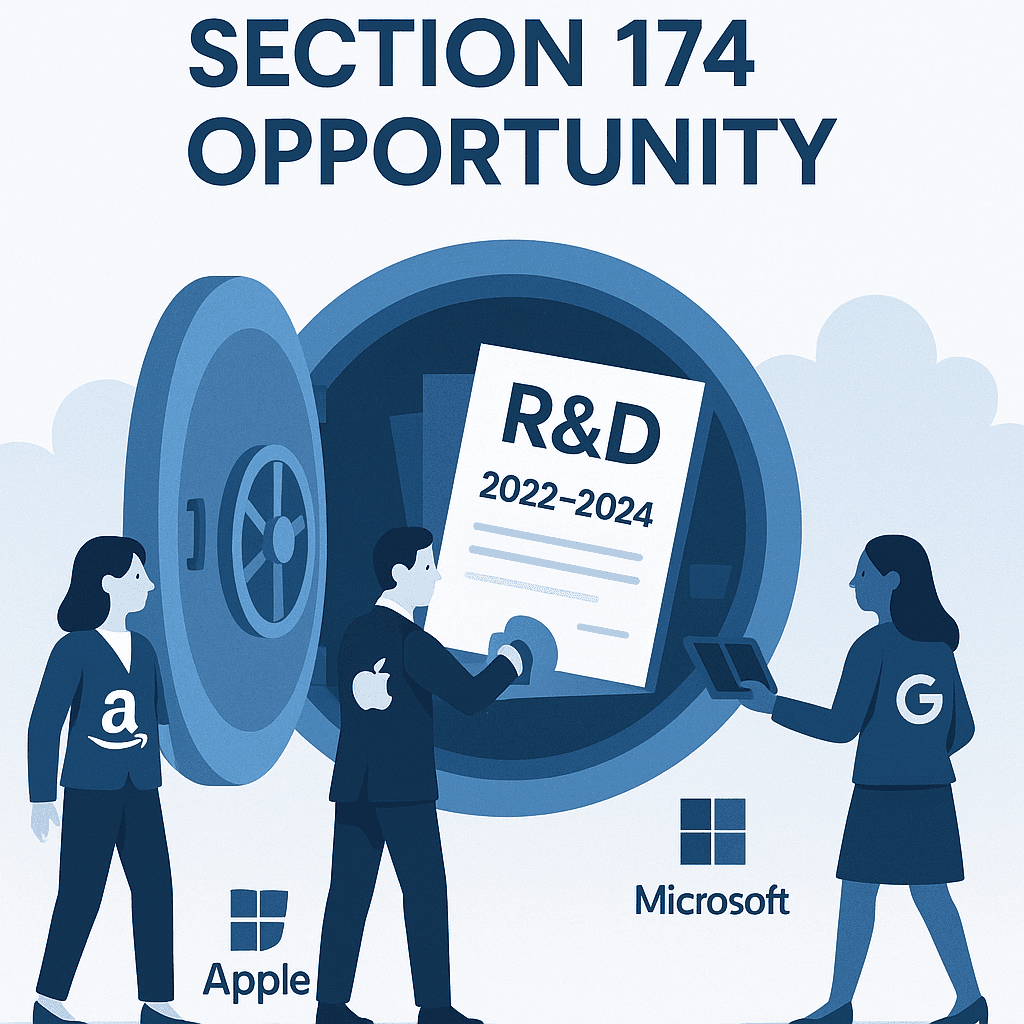

The restoration of Section 174 in 2025 created a rare opportunity for US tech companies: claim refunds for R&D work completed during 2022-2024. For qualifying companies with engineering teams, this could mean six-figure refunds, real money that can extend runway, fund new initiatives, or strengthen balance sheets.

But here's the challenge: most companies that qualify won't successfully claim their refunds. The barrier isn't eligibility, it's documentation. The IRS requires detailed, contemporaneous evidence of engineering work, and almost no company maintains the records they need.

This guide explains what Section 174 means for engineering leaders and managers, who qualifies, and how to overcome the documentation challenge using modern engineering intelligence platforms.

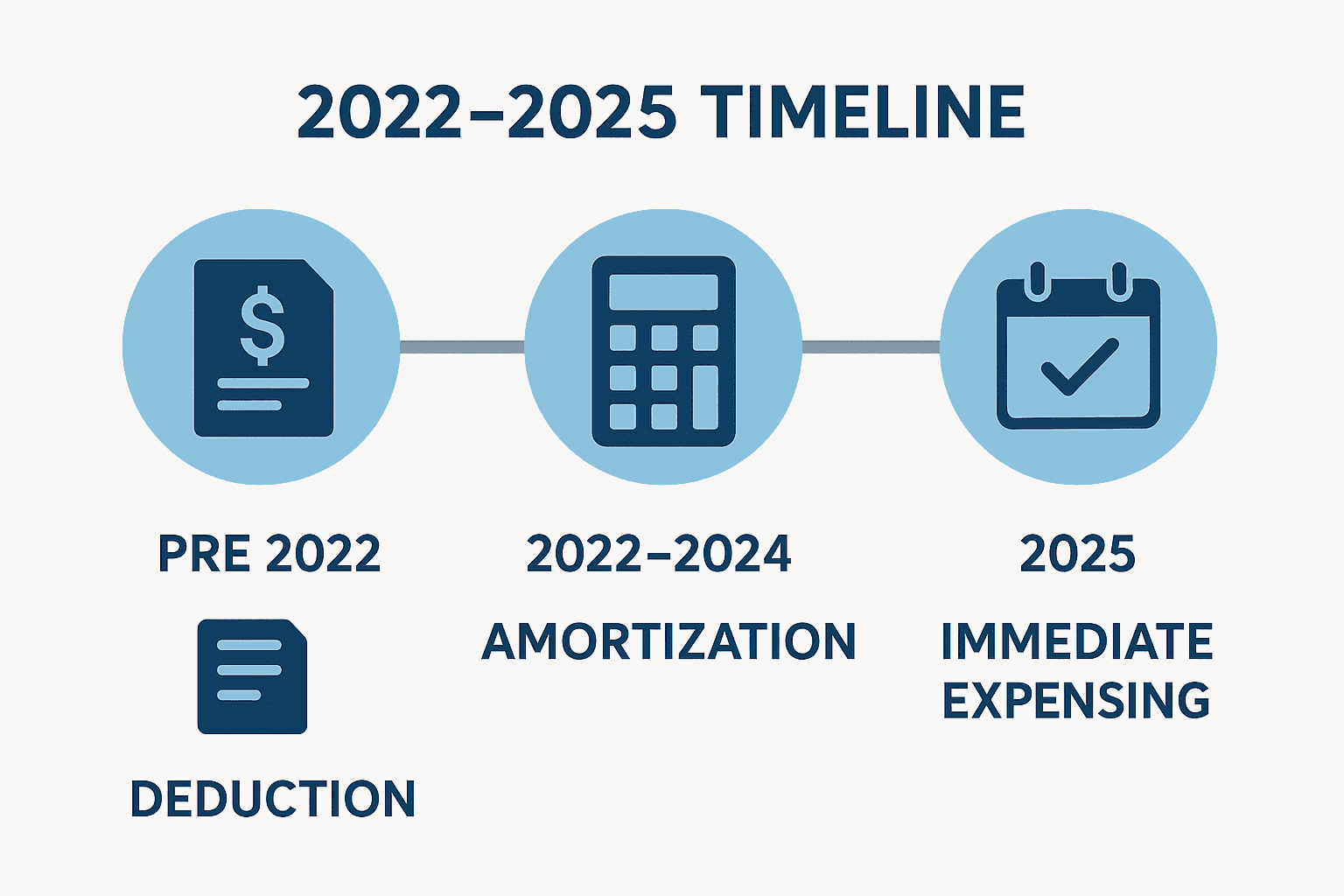

What Changed and Why It Matters

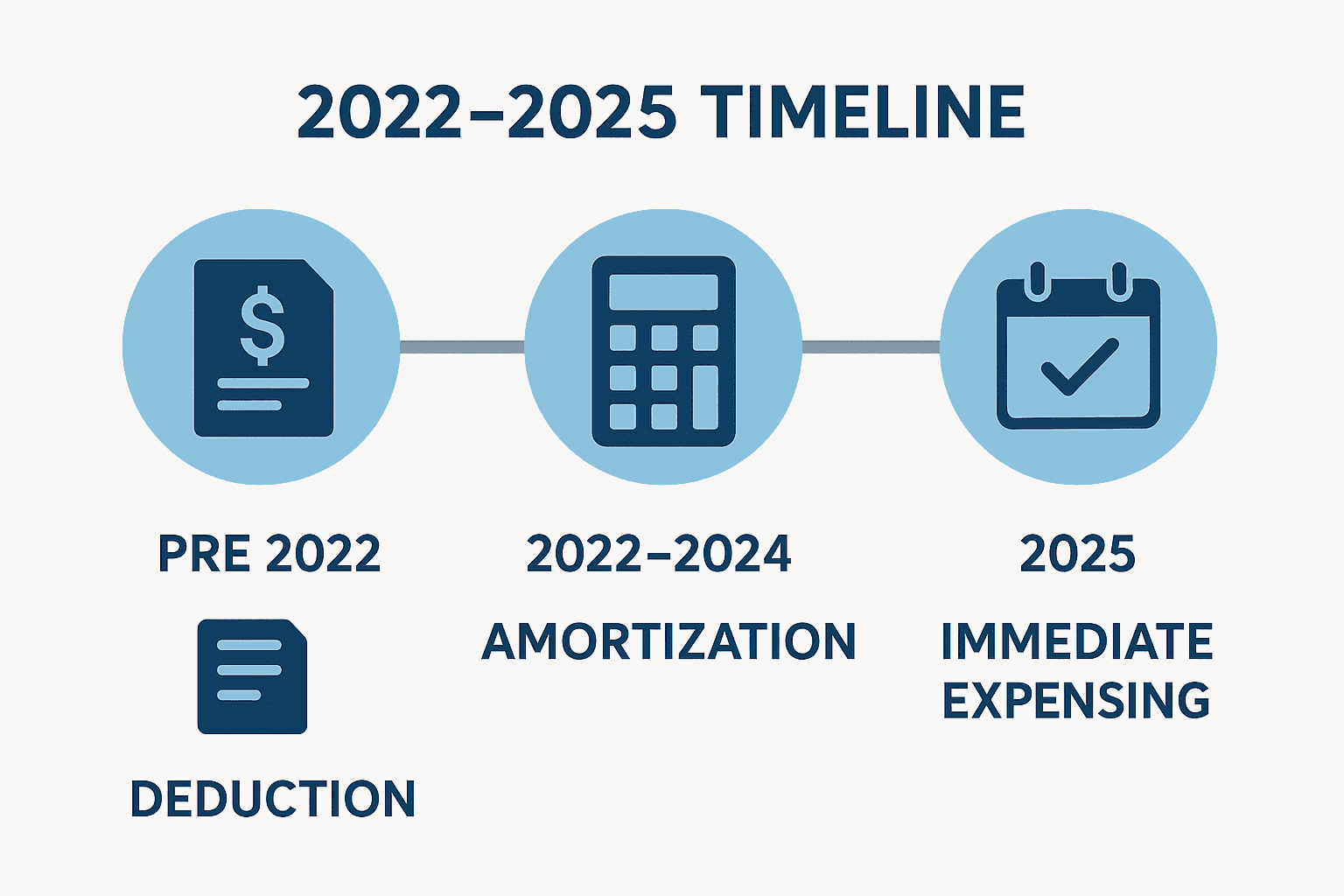

Section 174 governs how companies deduct research and development expenses. For software companies, this primarily means engineering salaries, your largest expense category.

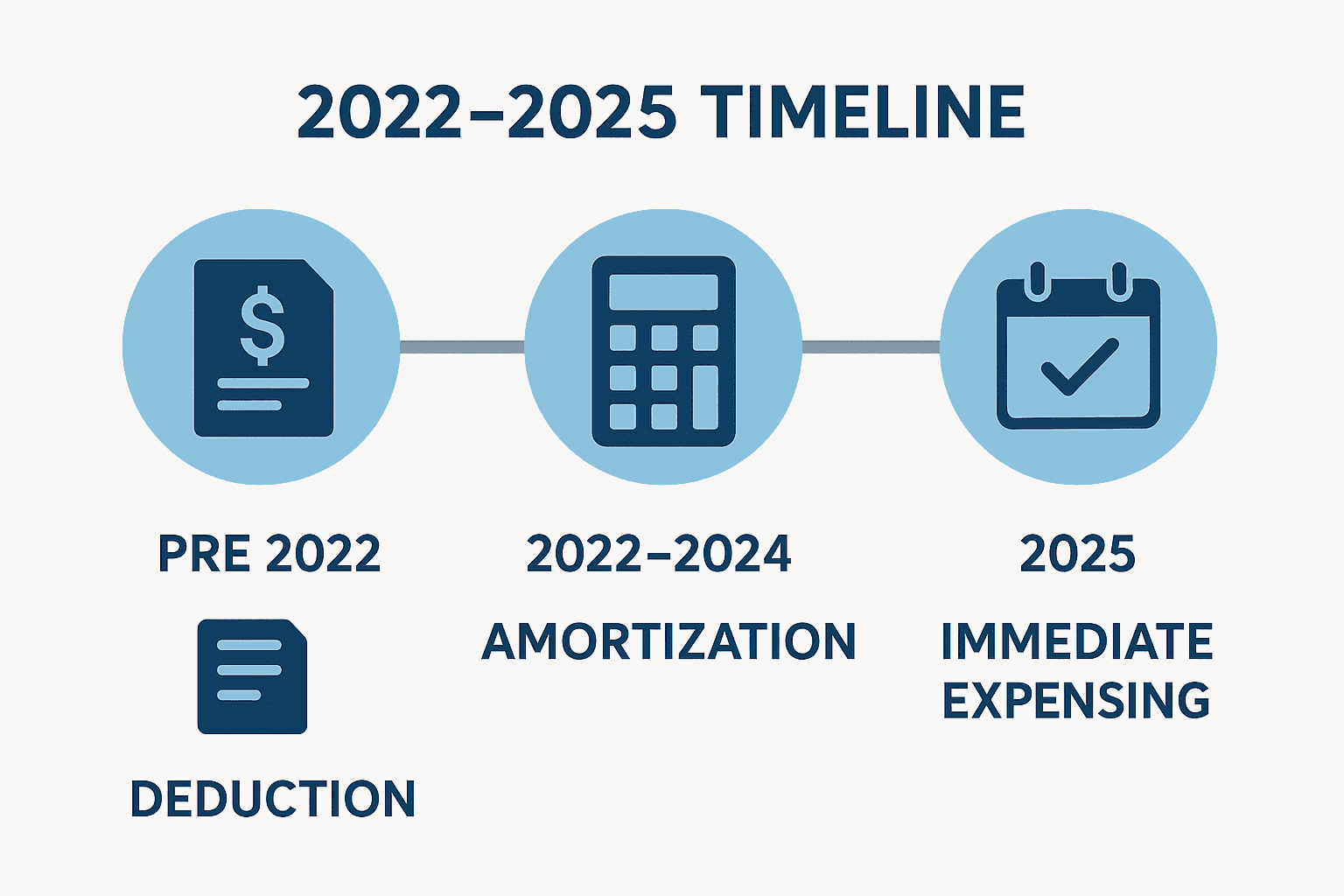

Pre-2022: The Golden Era: Companies could fully deduct R&D expenses in the year they occurred. Spend $2M on engineering in 2021? Deduct the full $2M in 2021. This aligned tax treatment with business reality.

2022-2024: Forced Amortization: The Tax Cuts and Jobs Act changed the rules effective 2022. Companies had to amortize R&D expenses over 5 years for domestic work (US-based engineers) and 15 years for foreign work. This created severe cash flow problems.

For example, a 15 engineer startup spending around 2.1M dollars annually on R&D can see its first year tax benefit drop by hundreds of thousands of dollars under forced amortization. That kind of hit can easily mean several months less runway, enough to turn an 18 month plan into something closer to 15 months.

2025: Restoration with Retroactive Relief: The 2025 tax bill restored immediate expensing for domestic R&D. More importantly, companies qualifying as "small businesses" (≤$31M average revenue across 2022-2024) can file amended returns to reclaim overpaid taxes.

This retroactive provision is the real opportunity. You've already done the work. You've already paid the taxes. Now you can get that money back, if you have the documentation.

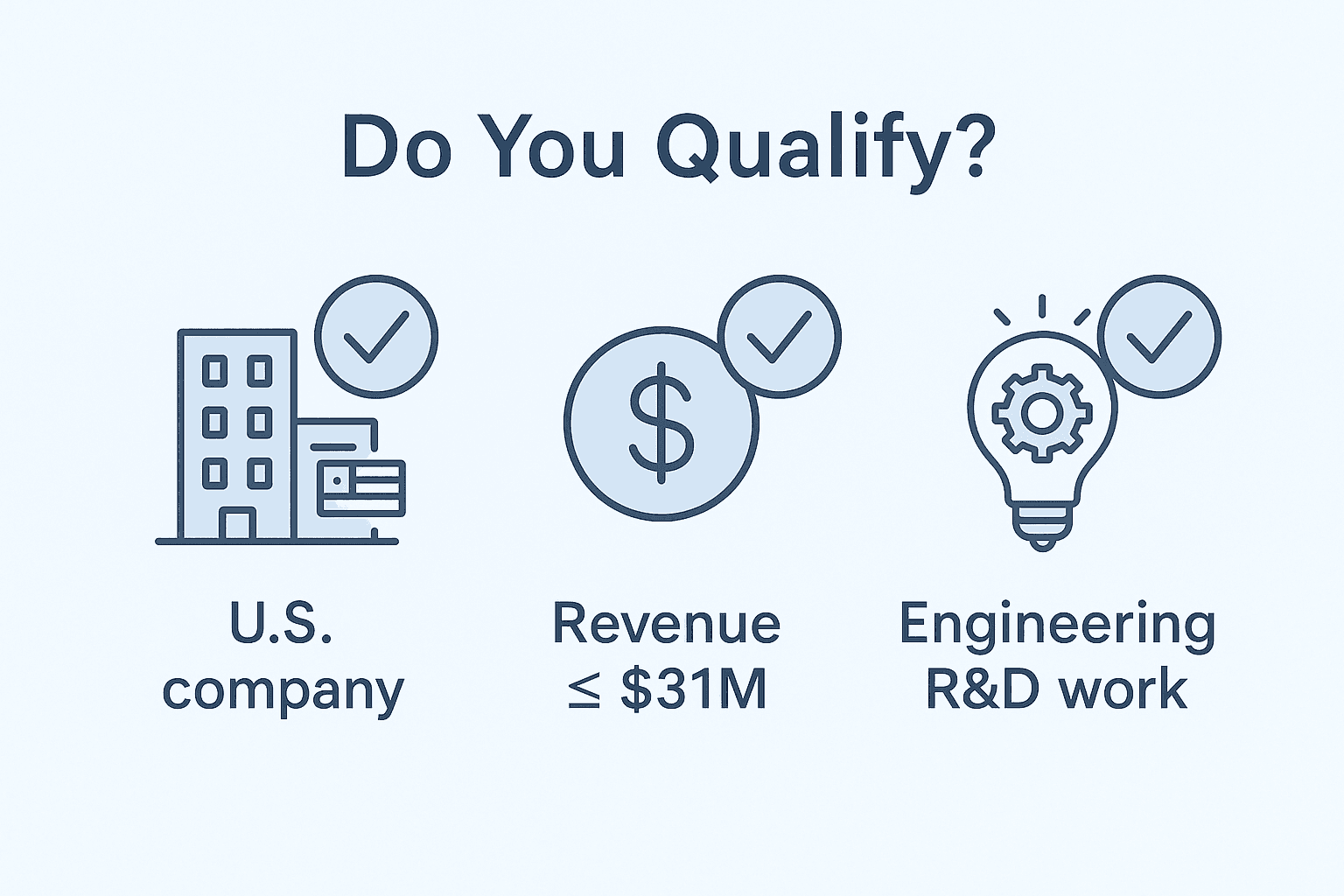

Who Qualifies for Retroactive Refunds

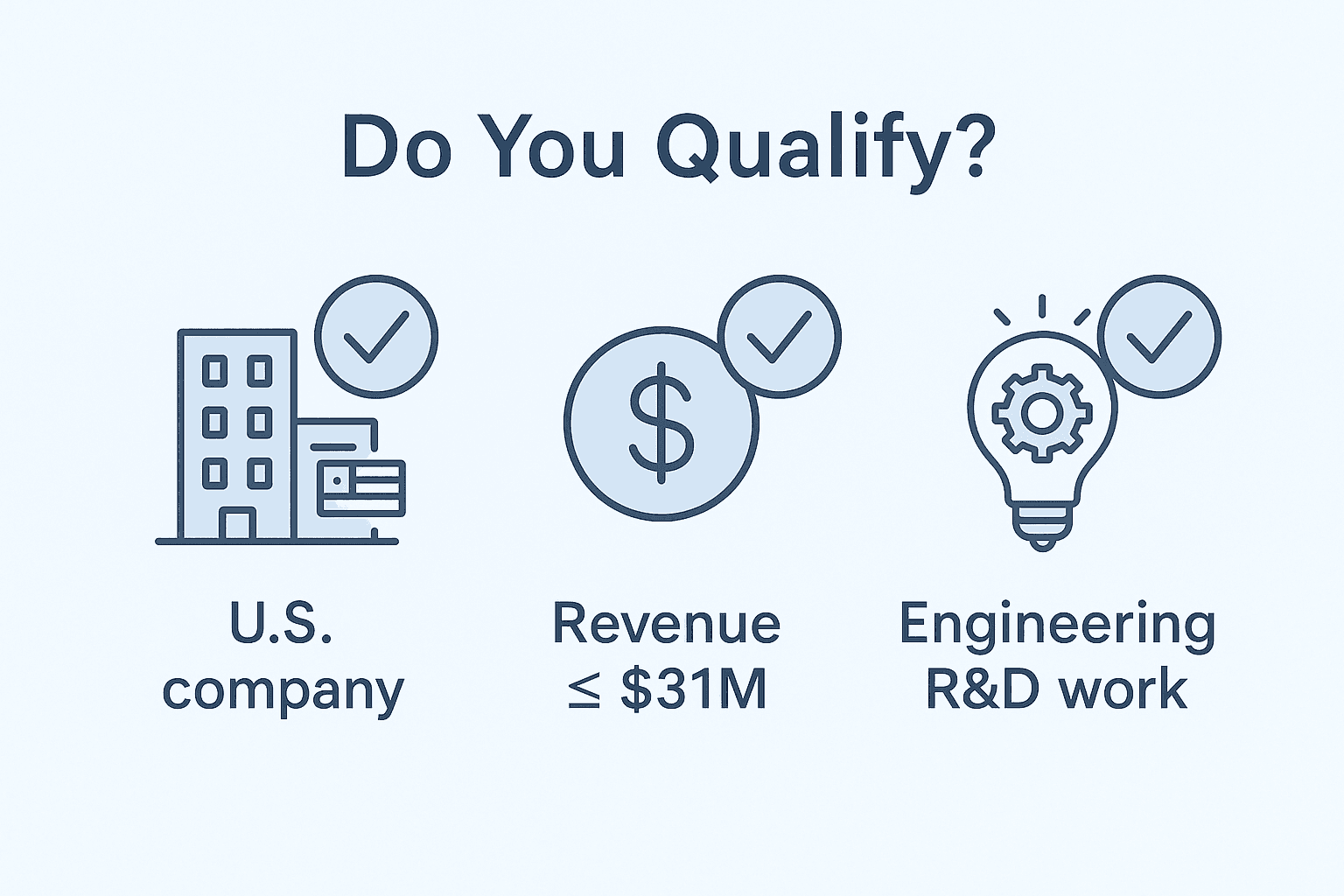

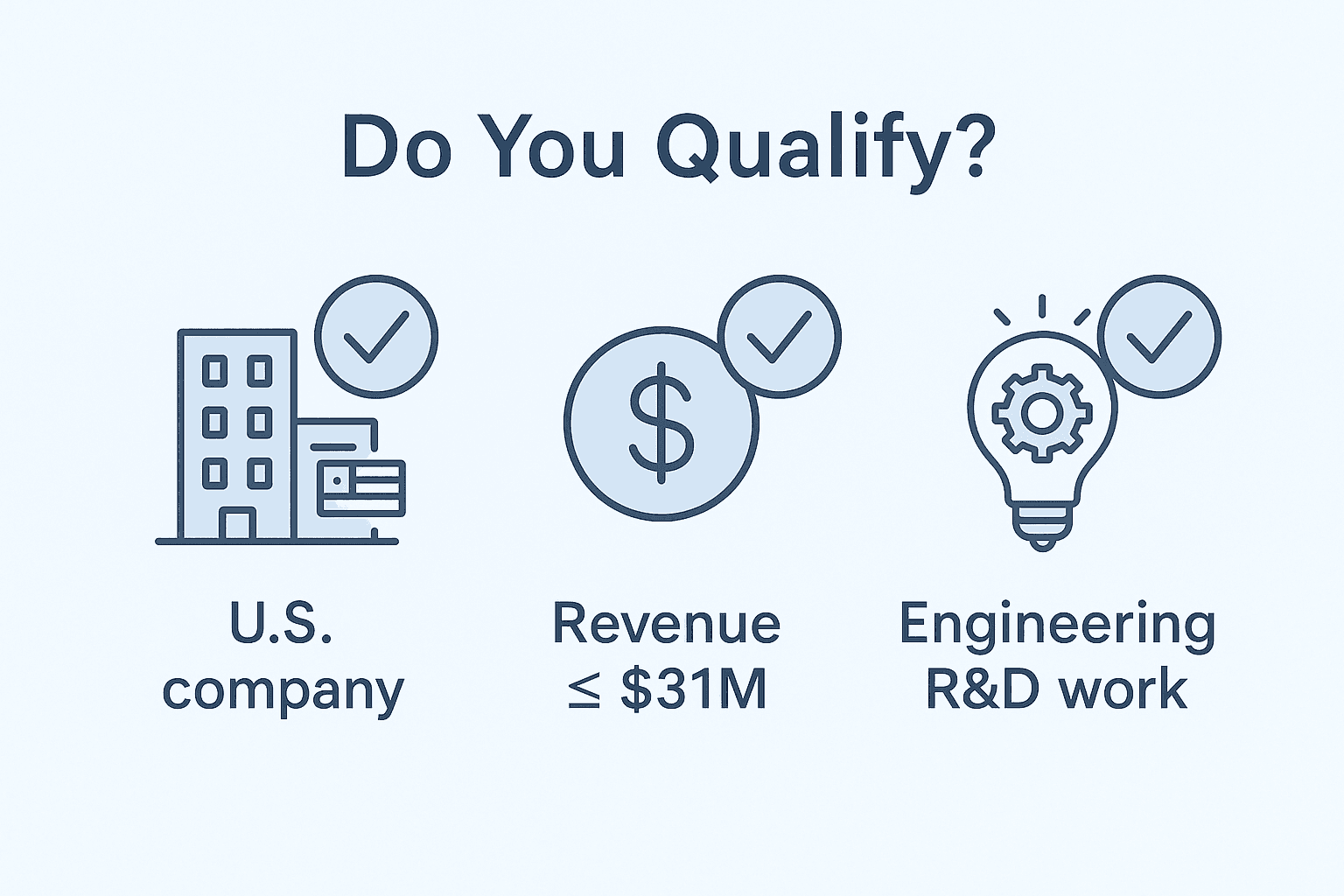

Three criteria determine eligibility:

1. US-Based Tech Company

Incorporated in the US

Filing US federal tax returns (Form 1120 or 1120S)

Paid taxes on R&D expenses during 2022-2024

2. Revenue ≤ $31M Average Calculate: (2022 revenue + 2023 revenue + 2024 revenue) ÷ 3

This averaging helps rapidly growing startups. Even if you hit $45M in 2024, if you were $8M in 2022 and $20M in 2023, your average is $24.3M, you qualify.

3. R&D Work by Engineers Most software product development qualifies as R&D:

New feature development

Performance optimization requiring novel approaches

Architecture improvements addressing technical uncertainty

Internal tools advancing capabilities

Experimental initiatives

What typically doesn't qualify:

Routine bug fixes using known solutions

Operational work (monitoring, incident response)

Customer support activities

Most engineering organizations spend 60-80% of time on qualifying R&D work. Claiming 100% triggers audits; being conservative and well-documented is better than aggressive and poorly-documented.

The Documentation Challenge

Here's why most companies fail: The IRS requires detailed documentation showing:

Who performed R&D work (specific engineers)

What work they performed (specific projects)

When it occurred (time periods and allocation)

How much time was spent (hours or percentages)

Why it qualifies as R&D (technical uncertainty addressed)

Geographic location (domestic vs. foreign)

Most engineering teams don't have this data. Manual reconstruction fails because:

Memory is unreliable: Can you accurately recall what you worked on in Q2 2022? Most people can't recall work from three months ago, let alone three years.

Employees leave: With 15-20% annual turnover, you've lost 45% of your 2022 team by 2025. Their contributions vanish from institutional memory.

Project management tools don't capture effort: Jira shows what was built, not how much time it took. A 2-point story might represent 5 hours or 50 hours, you can't tell from the ticket.

Surveys produce useless data: Engineers who left can't respond. Current engineers don't remember details. Responses are unverifiable estimates, not the contemporaneous records the IRS wants.

One CFO spent 300+ hours attempting manual documentation for a $800K potential refund. After interviewing engineers and reviewing incomplete records, they had documentation for less than 50% of their work, and their tax advisor said it wouldn't withstand audit. They ultimately claimed only $200K, leaving $600K on the table.

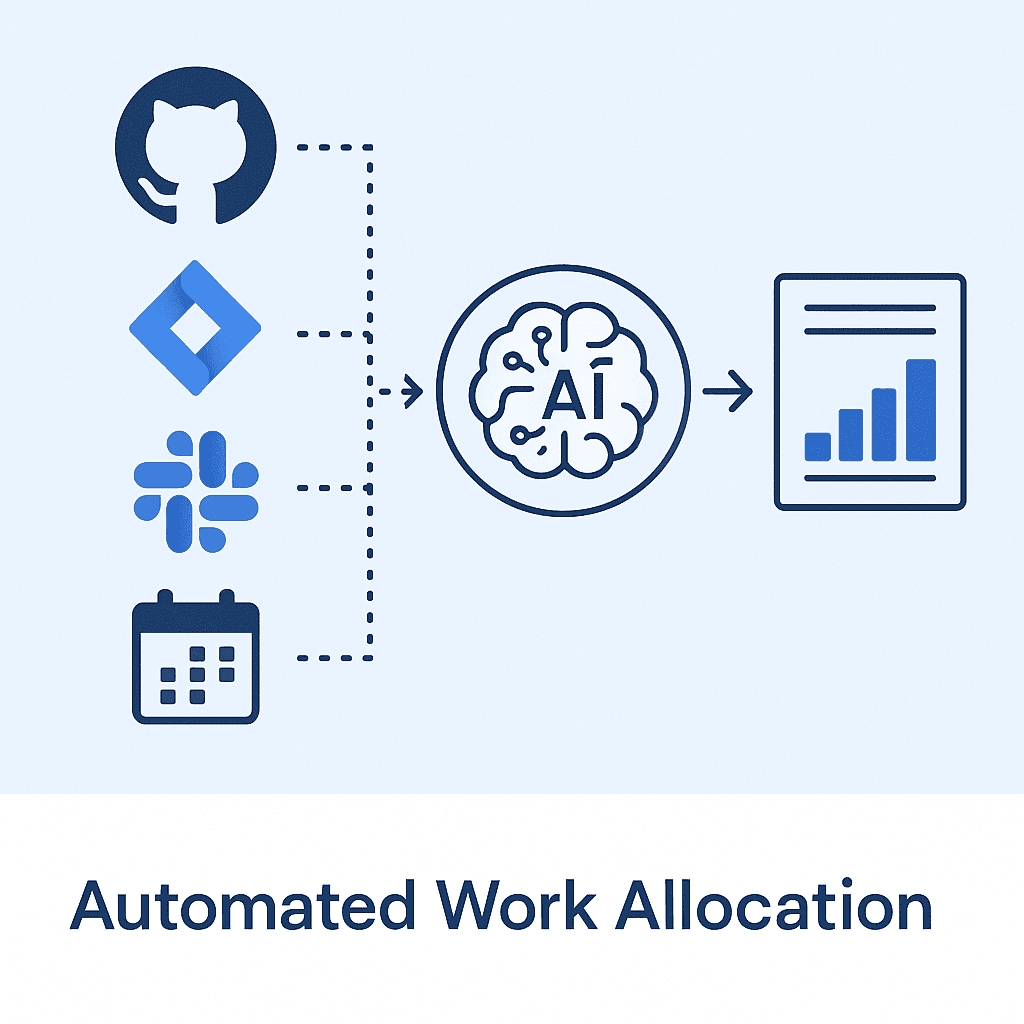

How Engineering Intelligence Platforms Solve This

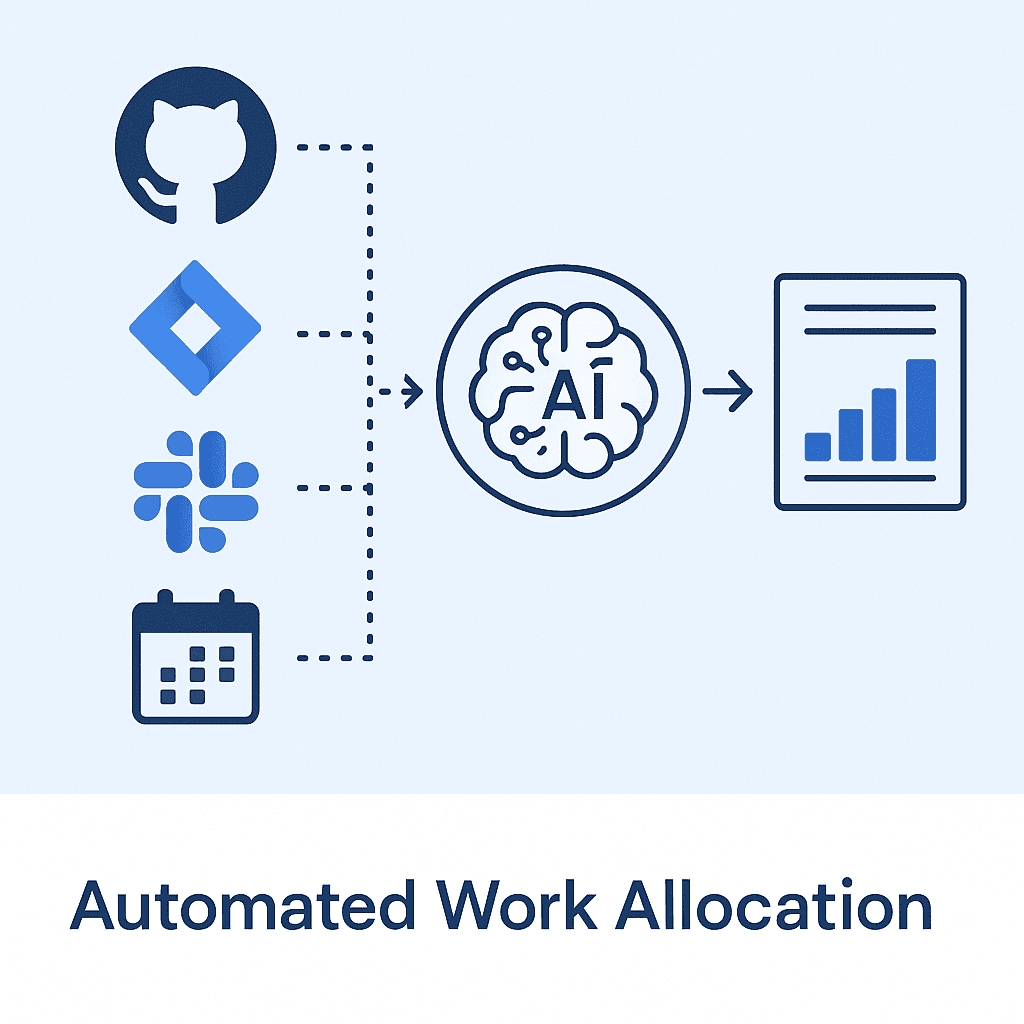

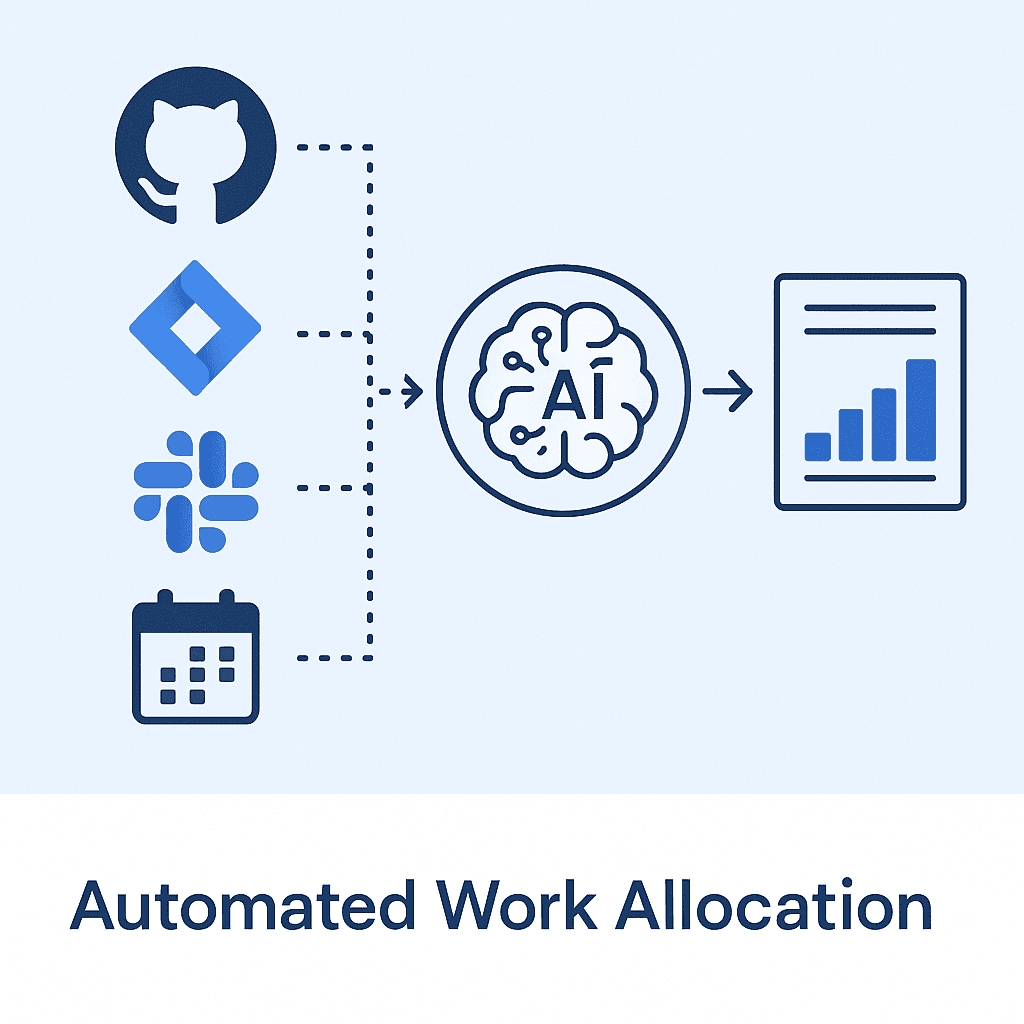

The solution is automated analysis of work your team already performed. Modern engineering intelligence platforms connect to your existing tools, GitHub, GitLab, Bitbucket, Jira, Linear, GitHub Issues, Slack, Notion, Confluence, Google Calendar, and reconstruct what engineers worked on by analyzing:

Code repositories: Every commit, branch, and pull request contains metadata about who worked on what, when.

Project management: Tickets and epics show project context and timelines.

Communication tools: Slack threads and documentation provide additional context.

Calendar data: Meeting patterns show collaboration and time allocation.

The platform automatically:

Attributes engineering time to specific projects and initiatives

Categorizes work as R&D vs. operational based on commit content

Separates domestic vs. foreign work by team location

Generates IRS-ready documentation with supporting evidence

The key advantage: you don't need to have been using the platform during 2022-2024. The data already exists in your Git repositories and project management tools. Engineering intelligence platforms retroactively analyze this historical data.

Pensero's Approach to Section 174 Compliance

Pensero was built by engineers who understand both software development and compliance realities. The platform integrates with GitHub, GitLab, Bitbucket, Jira, Linear, GitHub Issues, Slack, Notion, Confluence, Google Calendar, Cursor, and Claude Code, without requiring developers to change how they work.

What Sets Pensero Apart

Retroactive Analysis: Because Pensero analyzes historical commit data and project records, it can document work from 2022-2024 even if you weren't using the platform back then. Your code repositories already contain the evidence; Pensero makes it visible and reportable.

Executive Summaries: Engineering data is complex. Pensero transforms raw commits, pull requests, and tickets into clear, human-readable reports that finance teams, tax advisors, and IRS auditors can actually understand. These aren't just data dumps, they're narratives explaining what your team built, why it qualified as R&D, and how time was allocated.

Built by Experts: Pensero's team has over 20 years of average experience in tech. They understand the difference between a three-line bug fix and a three-line architectural change, context that matters for R&D classification but requires engineering expertise to recognize.

Trusted by Engineering Leaders: Companies using Pensero include:

Travelperk: Travel management platform

Elfie.co: AI-powered assistant

Caravelo: Travel technology solutions

Flexible Pricing for Growing Teams

Free Tier:

A lightweight version of Pensero designed for small teams to explore the platform’s core concepts.

It does not include the granular, engineer level analysis required for Section 174 documentation, but it’s useful for understanding how automatic work attribution works in practice.

Premium:

A full one year commitment of $600 per engineer, required to process 12 months of historical data and unlock the features needed for Section 174 analysis.

This tier includes the advanced attribution, R&D classification, and documentation capabilities that tax advisors rely on.

Enterprise: Custom pricing for larger organizations with advanced compliance and integration requirements.

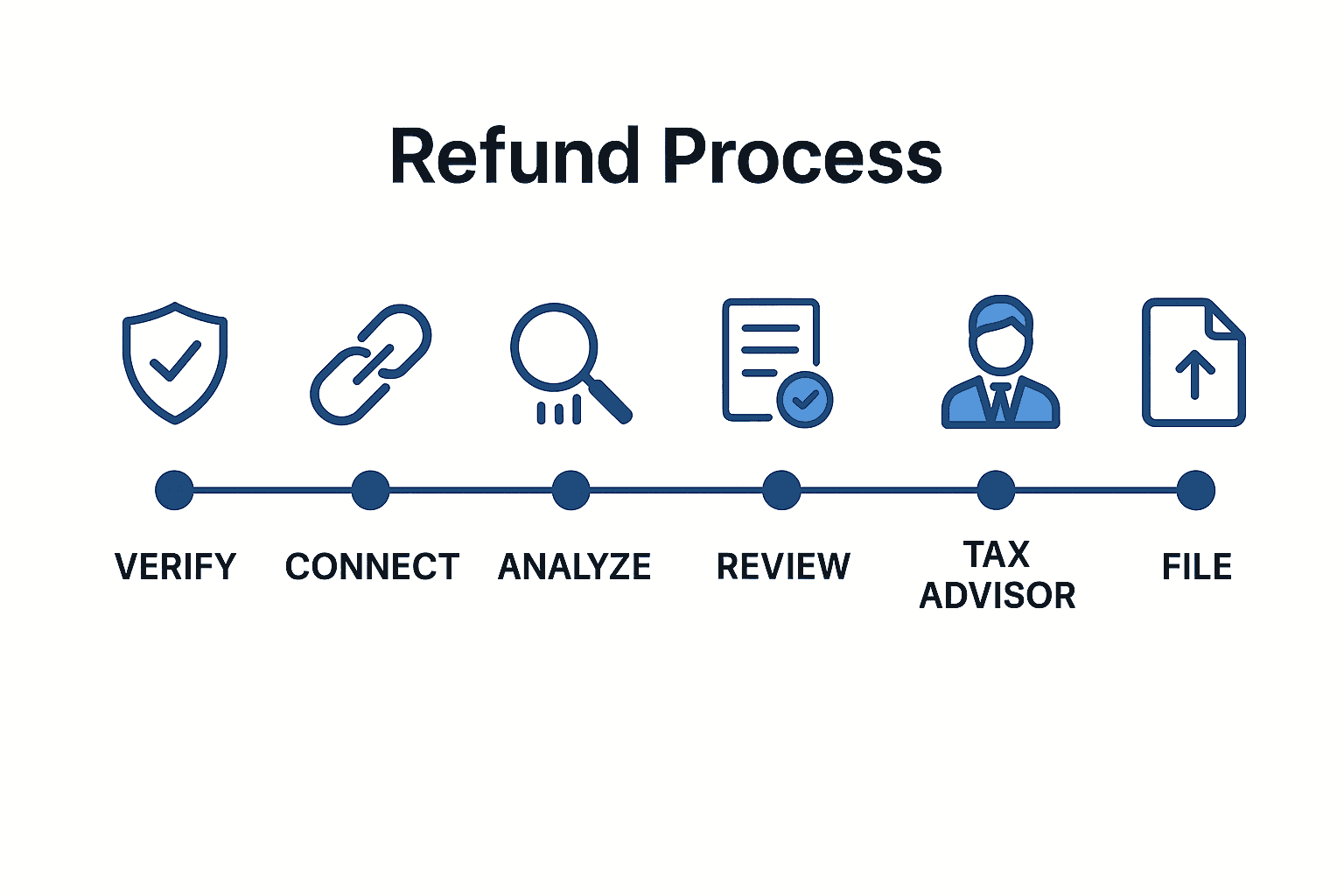

Practical Steps to Claim Your Refund

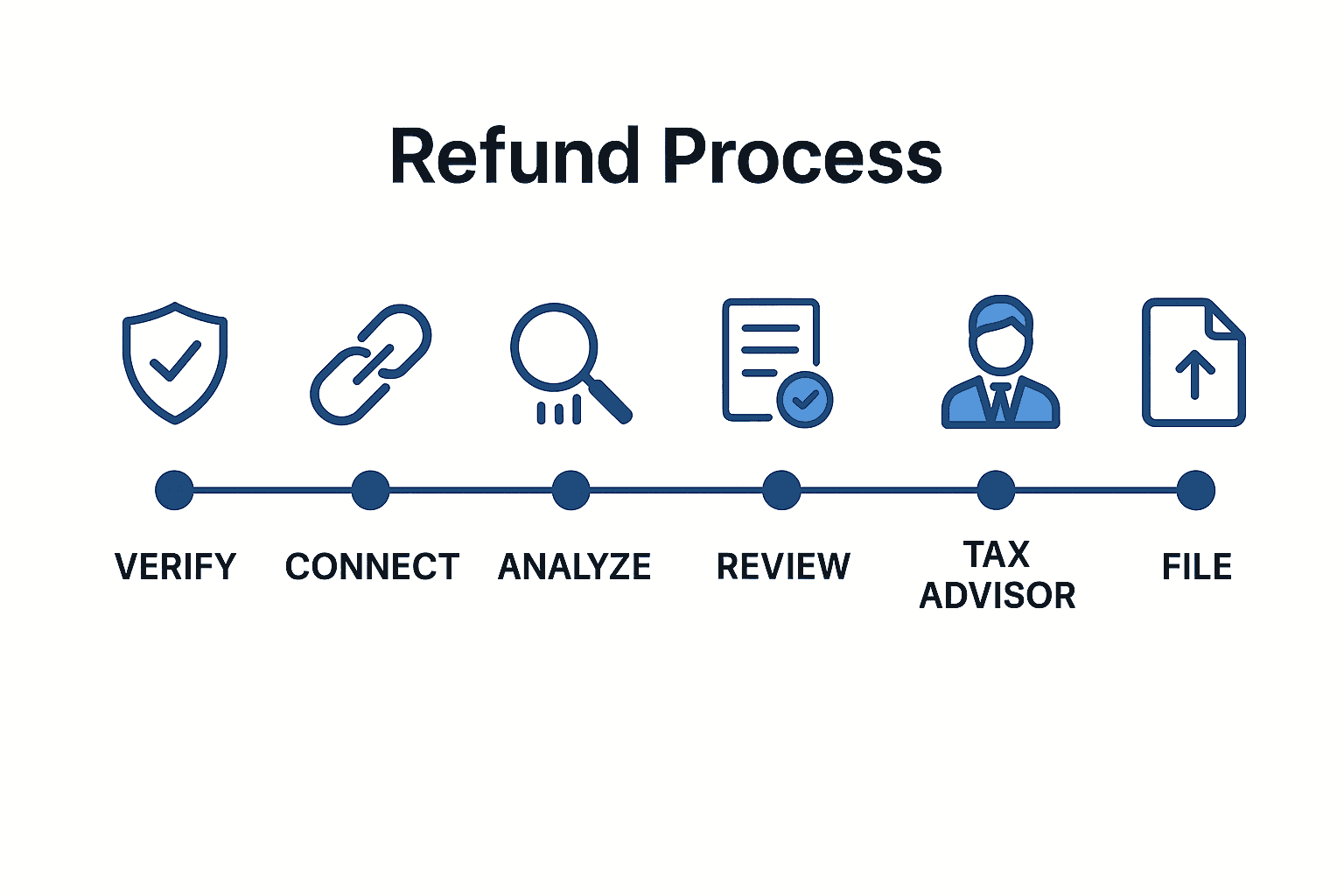

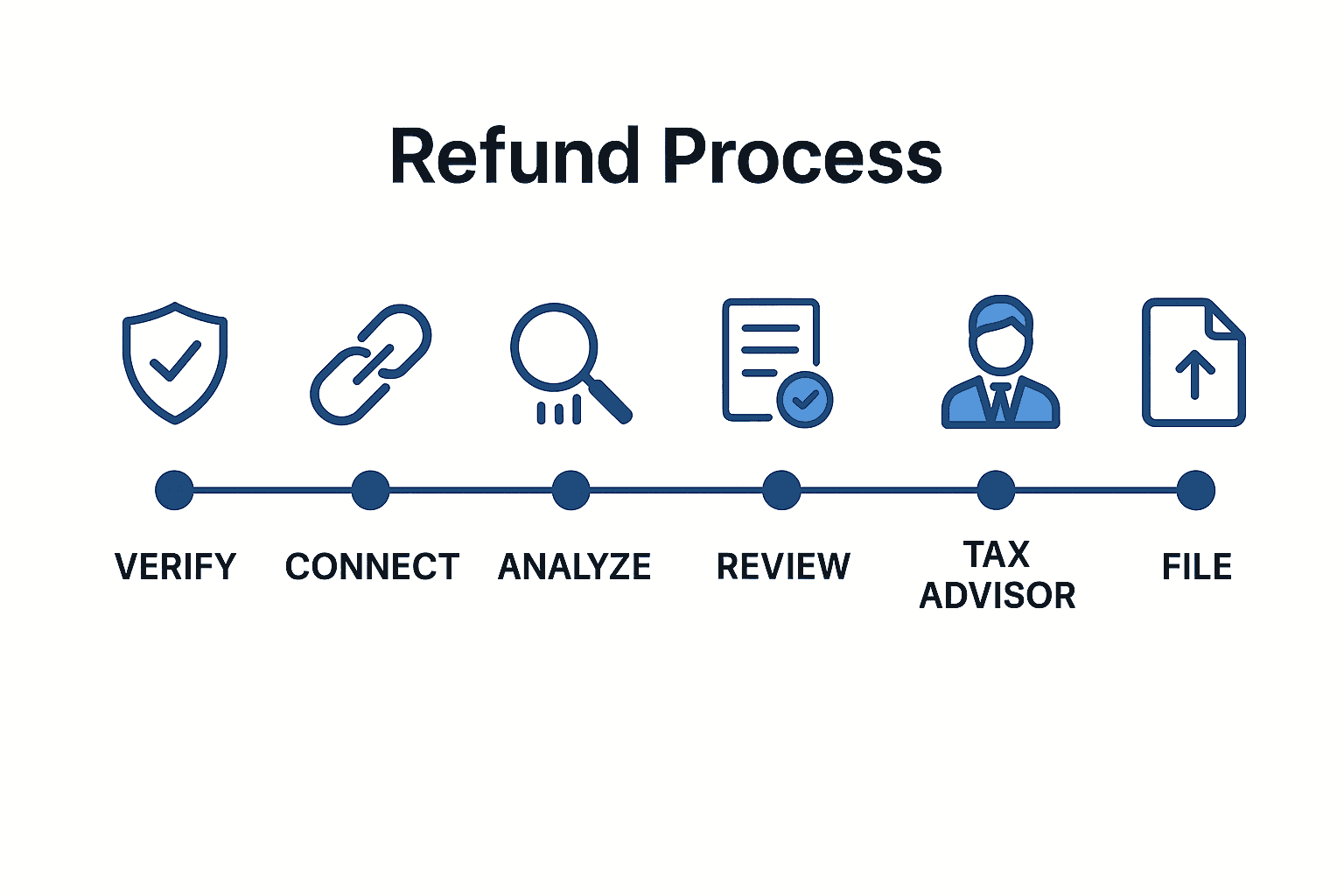

1. Verify Qualification (Week 1)

Calculate 3-year average revenue

Confirm US entity status and tax filing history

Verify code repositories and project records are accessible

2. Connect Your Data Sources (Week 2)

Link code repositories (GitHub, GitLab, Bitbucket)

Connect project management (Jira, Linear, GitHub Issues)

Integrate communication tools (Slack, Notion, Confluence)

For Pensero, this is a straightforward setup process that typically takes 2-3 hours.

3. Generate Historical Documentation (Weeks 3-4) The platform analyzes 2022-2024 data to produce:

Percentage of work delivered by engineer and initiative

R&D vs. operational classification

Domestic vs. foreign attribution

Supporting evidence from commits, PRs, and tickets

4. Review and Refine (Week 5) Work with the platform to:

Validate automated categorizations

Flag edge cases requiring manual review

Confirm domestic vs. foreign engineer locations

Generate preliminary reports

5. Tax Advisor Collaboration (Weeks 6-7) Provide IRS-ready documentation to your tax advisor. They'll:

Review documentation quality

Confirm qualification under current regulations

Prepare amended returns (Form 1120X)

Calculate precise refund amounts

6. File Amended Returns (Week 8) Your tax advisor files amended returns for qualifying years:

2022 returns: Due by April 2026

2023 returns: Due by April 2027

2024 returns: Due by April 2028

7. Track Refund Status (Ongoing) The IRS typically processes amended returns in 12-16 weeks. Refunds are direct-deposited to your business account.

What the Numbers Actually Look Like

10-Engineer Startup

R&D expense: $1.5M annually (10 × $150K average cost)

80% qualifying as R&D: $1.2M annually

3-year total: $3.6M

Tax overpayment at 21% rate: ~$600K

25-Engineer Growth Company

R&D expense: $3.75M annually (25 × $150K)

75% qualifying: $2.8M annually

3-year total: $8.4M

Tax overpayment: ~$1.4M

50-Engineer Established Company

R&D expense: $8M annually (50 × $160K)

70% qualifying: $5.6M annually

3-year total: $16.8M

Tax overpayment: ~$2.8M

These aren't small numbers. For a startup, a $600K refund could extend runway by 6+ months, potentially the difference between reaching profitability and shutting down.

Beyond the Refund: Long-Term Benefits

Implementing automatic work allocation for Section 174 delivers ongoing value:

Resource Planning: Understand how teams actually spend time. Which projects consume the most resources? Where are hidden time sinks? Make data-driven decisions about where to invest engineering effort.

Productivity Insights: Identify which types of work generate the most value versus create technical debt. Spot bottlenecks before they become crises.

Project Forecasting: Historical work allocation data improves future estimates. When similar work took 200 hours last time, your next estimate has real foundation.

Continuous Compliance: Once set up, automatic work allocation ensures ongoing Section 174 compliance. No scrambling at tax season, the documentation is always current.

Developer Experience: Unlike manual time tracking, automatic work allocation requires zero overhead from developers. They work normally while the platform handles documentation behind the scenes.

The Time Window Is Closing

You have three years from the original filing date to amend returns:

2022 returns: Deadline April 2026 (14 months away)

2023 returns: Deadline April 2027 (26 months away)

2024 returns: Deadline April 2028 (38 months away)

With 3-6 months required for proper documentation and filing, your real window is shorter than it appears. Companies that wait until 2026 to start will struggle to complete 2022 documentation before the deadline.

The Section 174 opportunity won't last forever. File amended returns within the window, or permanently lose the ability to claim refunds.

Take Action Now

If you qualify:

Evaluate your potential refund: Use the formulas above to estimate your 3-year overpayment

Set up engineering intelligence: Implement Pensero or similar platform to analyze historical work

Generate documentation: Produce IRS-ready reports within 4-6 weeks

Work with your tax advisor: File amended returns before deadlines

If you're unsure whether you qualify:

Calculate your 3-year average revenue precisely

Review with your tax advisor

Even if you don't qualify for retroactive relief, you benefit from immediate expensing starting 2025

The money is there. The documentation challenge is solvable. The question is whether you'll act before the window closes.

Frequently Asked Questions

Will the IRS accept automatically generated documentation?

Yes, provided it's based on objective data (commits, PRs, tickets) rather than estimates. The IRS wants reliable evidence; automatic tracking often provides better evidence than manual timesheets.

What if engineers worked overseas?

The platform separates domestic and foreign work. Foreign R&D expenses still follow 15-year amortization, so proper attribution is crucial for maximizing your refund.

Can we implement this mid-year

Yes. Automatic work allocation analyzes historical data, so you can implement today and still document work from years ago.

What about engineers who left

Their commits and PRs remain in your repositories. The platform documents their work even if they're no longer with the company.

How accurate is automated categorization

Modern platforms achieve 85-90% accuracy on R&D vs. operational classification. Edge cases are flagged for human review, ensuring high-quality results.

The restoration of Section 174 in 2025 created a rare opportunity for US tech companies: claim refunds for R&D work completed during 2022-2024. For qualifying companies with engineering teams, this could mean six-figure refunds, real money that can extend runway, fund new initiatives, or strengthen balance sheets.

But here's the challenge: most companies that qualify won't successfully claim their refunds. The barrier isn't eligibility, it's documentation. The IRS requires detailed, contemporaneous evidence of engineering work, and almost no company maintains the records they need.

This guide explains what Section 174 means for engineering leaders and managers, who qualifies, and how to overcome the documentation challenge using modern engineering intelligence platforms.

What Changed and Why It Matters

Section 174 governs how companies deduct research and development expenses. For software companies, this primarily means engineering salaries, your largest expense category.

Pre-2022: The Golden Era: Companies could fully deduct R&D expenses in the year they occurred. Spend $2M on engineering in 2021? Deduct the full $2M in 2021. This aligned tax treatment with business reality.

2022-2024: Forced Amortization: The Tax Cuts and Jobs Act changed the rules effective 2022. Companies had to amortize R&D expenses over 5 years for domestic work (US-based engineers) and 15 years for foreign work. This created severe cash flow problems.

For example, a 15 engineer startup spending around 2.1M dollars annually on R&D can see its first year tax benefit drop by hundreds of thousands of dollars under forced amortization. That kind of hit can easily mean several months less runway, enough to turn an 18 month plan into something closer to 15 months.

2025: Restoration with Retroactive Relief: The 2025 tax bill restored immediate expensing for domestic R&D. More importantly, companies qualifying as "small businesses" (≤$31M average revenue across 2022-2024) can file amended returns to reclaim overpaid taxes.

This retroactive provision is the real opportunity. You've already done the work. You've already paid the taxes. Now you can get that money back, if you have the documentation.

Who Qualifies for Retroactive Refunds

Three criteria determine eligibility:

1. US-Based Tech Company

Incorporated in the US

Filing US federal tax returns (Form 1120 or 1120S)

Paid taxes on R&D expenses during 2022-2024

2. Revenue ≤ $31M Average Calculate: (2022 revenue + 2023 revenue + 2024 revenue) ÷ 3

This averaging helps rapidly growing startups. Even if you hit $45M in 2024, if you were $8M in 2022 and $20M in 2023, your average is $24.3M, you qualify.

3. R&D Work by Engineers Most software product development qualifies as R&D:

New feature development

Performance optimization requiring novel approaches

Architecture improvements addressing technical uncertainty

Internal tools advancing capabilities

Experimental initiatives

What typically doesn't qualify:

Routine bug fixes using known solutions

Operational work (monitoring, incident response)

Customer support activities

Most engineering organizations spend 60-80% of time on qualifying R&D work. Claiming 100% triggers audits; being conservative and well-documented is better than aggressive and poorly-documented.

The Documentation Challenge

Here's why most companies fail: The IRS requires detailed documentation showing:

Who performed R&D work (specific engineers)

What work they performed (specific projects)

When it occurred (time periods and allocation)

How much time was spent (hours or percentages)

Why it qualifies as R&D (technical uncertainty addressed)

Geographic location (domestic vs. foreign)

Most engineering teams don't have this data. Manual reconstruction fails because:

Memory is unreliable: Can you accurately recall what you worked on in Q2 2022? Most people can't recall work from three months ago, let alone three years.

Employees leave: With 15-20% annual turnover, you've lost 45% of your 2022 team by 2025. Their contributions vanish from institutional memory.

Project management tools don't capture effort: Jira shows what was built, not how much time it took. A 2-point story might represent 5 hours or 50 hours, you can't tell from the ticket.

Surveys produce useless data: Engineers who left can't respond. Current engineers don't remember details. Responses are unverifiable estimates, not the contemporaneous records the IRS wants.

One CFO spent 300+ hours attempting manual documentation for a $800K potential refund. After interviewing engineers and reviewing incomplete records, they had documentation for less than 50% of their work, and their tax advisor said it wouldn't withstand audit. They ultimately claimed only $200K, leaving $600K on the table.

How Engineering Intelligence Platforms Solve This

The solution is automated analysis of work your team already performed. Modern engineering intelligence platforms connect to your existing tools, GitHub, GitLab, Bitbucket, Jira, Linear, GitHub Issues, Slack, Notion, Confluence, Google Calendar, and reconstruct what engineers worked on by analyzing:

Code repositories: Every commit, branch, and pull request contains metadata about who worked on what, when.

Project management: Tickets and epics show project context and timelines.

Communication tools: Slack threads and documentation provide additional context.

Calendar data: Meeting patterns show collaboration and time allocation.

The platform automatically:

Attributes engineering time to specific projects and initiatives

Categorizes work as R&D vs. operational based on commit content

Separates domestic vs. foreign work by team location

Generates IRS-ready documentation with supporting evidence

The key advantage: you don't need to have been using the platform during 2022-2024. The data already exists in your Git repositories and project management tools. Engineering intelligence platforms retroactively analyze this historical data.

Pensero's Approach to Section 174 Compliance

Pensero was built by engineers who understand both software development and compliance realities. The platform integrates with GitHub, GitLab, Bitbucket, Jira, Linear, GitHub Issues, Slack, Notion, Confluence, Google Calendar, Cursor, and Claude Code, without requiring developers to change how they work.

What Sets Pensero Apart

Retroactive Analysis: Because Pensero analyzes historical commit data and project records, it can document work from 2022-2024 even if you weren't using the platform back then. Your code repositories already contain the evidence; Pensero makes it visible and reportable.

Executive Summaries: Engineering data is complex. Pensero transforms raw commits, pull requests, and tickets into clear, human-readable reports that finance teams, tax advisors, and IRS auditors can actually understand. These aren't just data dumps, they're narratives explaining what your team built, why it qualified as R&D, and how time was allocated.

Built by Experts: Pensero's team has over 20 years of average experience in tech. They understand the difference between a three-line bug fix and a three-line architectural change, context that matters for R&D classification but requires engineering expertise to recognize.

Trusted by Engineering Leaders: Companies using Pensero include:

Travelperk: Travel management platform

Elfie.co: AI-powered assistant

Caravelo: Travel technology solutions

Flexible Pricing for Growing Teams

Free Tier:

A lightweight version of Pensero designed for small teams to explore the platform’s core concepts.

It does not include the granular, engineer level analysis required for Section 174 documentation, but it’s useful for understanding how automatic work attribution works in practice.

Premium:

A full one year commitment of $600 per engineer, required to process 12 months of historical data and unlock the features needed for Section 174 analysis.

This tier includes the advanced attribution, R&D classification, and documentation capabilities that tax advisors rely on.

Enterprise: Custom pricing for larger organizations with advanced compliance and integration requirements.

Practical Steps to Claim Your Refund

1. Verify Qualification (Week 1)

Calculate 3-year average revenue

Confirm US entity status and tax filing history

Verify code repositories and project records are accessible

2. Connect Your Data Sources (Week 2)

Link code repositories (GitHub, GitLab, Bitbucket)

Connect project management (Jira, Linear, GitHub Issues)

Integrate communication tools (Slack, Notion, Confluence)

For Pensero, this is a straightforward setup process that typically takes 2-3 hours.

3. Generate Historical Documentation (Weeks 3-4) The platform analyzes 2022-2024 data to produce:

Percentage of work delivered by engineer and initiative

R&D vs. operational classification

Domestic vs. foreign attribution

Supporting evidence from commits, PRs, and tickets

4. Review and Refine (Week 5) Work with the platform to:

Validate automated categorizations

Flag edge cases requiring manual review

Confirm domestic vs. foreign engineer locations

Generate preliminary reports

5. Tax Advisor Collaboration (Weeks 6-7) Provide IRS-ready documentation to your tax advisor. They'll:

Review documentation quality

Confirm qualification under current regulations

Prepare amended returns (Form 1120X)

Calculate precise refund amounts

6. File Amended Returns (Week 8) Your tax advisor files amended returns for qualifying years:

2022 returns: Due by April 2026

2023 returns: Due by April 2027

2024 returns: Due by April 2028

7. Track Refund Status (Ongoing) The IRS typically processes amended returns in 12-16 weeks. Refunds are direct-deposited to your business account.

What the Numbers Actually Look Like

10-Engineer Startup

R&D expense: $1.5M annually (10 × $150K average cost)

80% qualifying as R&D: $1.2M annually

3-year total: $3.6M

Tax overpayment at 21% rate: ~$600K

25-Engineer Growth Company

R&D expense: $3.75M annually (25 × $150K)

75% qualifying: $2.8M annually

3-year total: $8.4M

Tax overpayment: ~$1.4M

50-Engineer Established Company

R&D expense: $8M annually (50 × $160K)

70% qualifying: $5.6M annually

3-year total: $16.8M

Tax overpayment: ~$2.8M

These aren't small numbers. For a startup, a $600K refund could extend runway by 6+ months, potentially the difference between reaching profitability and shutting down.

Beyond the Refund: Long-Term Benefits

Implementing automatic work allocation for Section 174 delivers ongoing value:

Resource Planning: Understand how teams actually spend time. Which projects consume the most resources? Where are hidden time sinks? Make data-driven decisions about where to invest engineering effort.

Productivity Insights: Identify which types of work generate the most value versus create technical debt. Spot bottlenecks before they become crises.

Project Forecasting: Historical work allocation data improves future estimates. When similar work took 200 hours last time, your next estimate has real foundation.

Continuous Compliance: Once set up, automatic work allocation ensures ongoing Section 174 compliance. No scrambling at tax season, the documentation is always current.

Developer Experience: Unlike manual time tracking, automatic work allocation requires zero overhead from developers. They work normally while the platform handles documentation behind the scenes.

The Time Window Is Closing

You have three years from the original filing date to amend returns:

2022 returns: Deadline April 2026 (14 months away)

2023 returns: Deadline April 2027 (26 months away)

2024 returns: Deadline April 2028 (38 months away)

With 3-6 months required for proper documentation and filing, your real window is shorter than it appears. Companies that wait until 2026 to start will struggle to complete 2022 documentation before the deadline.

The Section 174 opportunity won't last forever. File amended returns within the window, or permanently lose the ability to claim refunds.

Take Action Now

If you qualify:

Evaluate your potential refund: Use the formulas above to estimate your 3-year overpayment

Set up engineering intelligence: Implement Pensero or similar platform to analyze historical work

Generate documentation: Produce IRS-ready reports within 4-6 weeks

Work with your tax advisor: File amended returns before deadlines

If you're unsure whether you qualify:

Calculate your 3-year average revenue precisely

Review with your tax advisor

Even if you don't qualify for retroactive relief, you benefit from immediate expensing starting 2025

The money is there. The documentation challenge is solvable. The question is whether you'll act before the window closes.

Frequently Asked Questions

Will the IRS accept automatically generated documentation?

Yes, provided it's based on objective data (commits, PRs, tickets) rather than estimates. The IRS wants reliable evidence; automatic tracking often provides better evidence than manual timesheets.

What if engineers worked overseas?

The platform separates domestic and foreign work. Foreign R&D expenses still follow 15-year amortization, so proper attribution is crucial for maximizing your refund.

Can we implement this mid-year

Yes. Automatic work allocation analyzes historical data, so you can implement today and still document work from years ago.

What about engineers who left

Their commits and PRs remain in your repositories. The platform documents their work even if they're no longer with the company.

How accurate is automated categorization

Modern platforms achieve 85-90% accuracy on R&D vs. operational classification. Edge cases are flagged for human review, ensuring high-quality results.

The restoration of Section 174 in 2025 created a rare opportunity for US tech companies: claim refunds for R&D work completed during 2022-2024. For qualifying companies with engineering teams, this could mean six-figure refunds, real money that can extend runway, fund new initiatives, or strengthen balance sheets.

But here's the challenge: most companies that qualify won't successfully claim their refunds. The barrier isn't eligibility, it's documentation. The IRS requires detailed, contemporaneous evidence of engineering work, and almost no company maintains the records they need.

This guide explains what Section 174 means for engineering leaders and managers, who qualifies, and how to overcome the documentation challenge using modern engineering intelligence platforms.

What Changed and Why It Matters

Section 174 governs how companies deduct research and development expenses. For software companies, this primarily means engineering salaries, your largest expense category.

Pre-2022: The Golden Era: Companies could fully deduct R&D expenses in the year they occurred. Spend $2M on engineering in 2021? Deduct the full $2M in 2021. This aligned tax treatment with business reality.

2022-2024: Forced Amortization: The Tax Cuts and Jobs Act changed the rules effective 2022. Companies had to amortize R&D expenses over 5 years for domestic work (US-based engineers) and 15 years for foreign work. This created severe cash flow problems.

For example, a 15 engineer startup spending around 2.1M dollars annually on R&D can see its first year tax benefit drop by hundreds of thousands of dollars under forced amortization. That kind of hit can easily mean several months less runway, enough to turn an 18 month plan into something closer to 15 months.

2025: Restoration with Retroactive Relief: The 2025 tax bill restored immediate expensing for domestic R&D. More importantly, companies qualifying as "small businesses" (≤$31M average revenue across 2022-2024) can file amended returns to reclaim overpaid taxes.

This retroactive provision is the real opportunity. You've already done the work. You've already paid the taxes. Now you can get that money back, if you have the documentation.

Who Qualifies for Retroactive Refunds

Three criteria determine eligibility:

1. US-Based Tech Company

Incorporated in the US

Filing US federal tax returns (Form 1120 or 1120S)

Paid taxes on R&D expenses during 2022-2024

2. Revenue ≤ $31M Average Calculate: (2022 revenue + 2023 revenue + 2024 revenue) ÷ 3

This averaging helps rapidly growing startups. Even if you hit $45M in 2024, if you were $8M in 2022 and $20M in 2023, your average is $24.3M, you qualify.

3. R&D Work by Engineers Most software product development qualifies as R&D:

New feature development

Performance optimization requiring novel approaches

Architecture improvements addressing technical uncertainty

Internal tools advancing capabilities

Experimental initiatives

What typically doesn't qualify:

Routine bug fixes using known solutions

Operational work (monitoring, incident response)

Customer support activities

Most engineering organizations spend 60-80% of time on qualifying R&D work. Claiming 100% triggers audits; being conservative and well-documented is better than aggressive and poorly-documented.

The Documentation Challenge

Here's why most companies fail: The IRS requires detailed documentation showing:

Who performed R&D work (specific engineers)

What work they performed (specific projects)

When it occurred (time periods and allocation)

How much time was spent (hours or percentages)

Why it qualifies as R&D (technical uncertainty addressed)

Geographic location (domestic vs. foreign)

Most engineering teams don't have this data. Manual reconstruction fails because:

Memory is unreliable: Can you accurately recall what you worked on in Q2 2022? Most people can't recall work from three months ago, let alone three years.

Employees leave: With 15-20% annual turnover, you've lost 45% of your 2022 team by 2025. Their contributions vanish from institutional memory.

Project management tools don't capture effort: Jira shows what was built, not how much time it took. A 2-point story might represent 5 hours or 50 hours, you can't tell from the ticket.

Surveys produce useless data: Engineers who left can't respond. Current engineers don't remember details. Responses are unverifiable estimates, not the contemporaneous records the IRS wants.

One CFO spent 300+ hours attempting manual documentation for a $800K potential refund. After interviewing engineers and reviewing incomplete records, they had documentation for less than 50% of their work, and their tax advisor said it wouldn't withstand audit. They ultimately claimed only $200K, leaving $600K on the table.

How Engineering Intelligence Platforms Solve This

The solution is automated analysis of work your team already performed. Modern engineering intelligence platforms connect to your existing tools, GitHub, GitLab, Bitbucket, Jira, Linear, GitHub Issues, Slack, Notion, Confluence, Google Calendar, and reconstruct what engineers worked on by analyzing:

Code repositories: Every commit, branch, and pull request contains metadata about who worked on what, when.

Project management: Tickets and epics show project context and timelines.

Communication tools: Slack threads and documentation provide additional context.

Calendar data: Meeting patterns show collaboration and time allocation.

The platform automatically:

Attributes engineering time to specific projects and initiatives

Categorizes work as R&D vs. operational based on commit content

Separates domestic vs. foreign work by team location

Generates IRS-ready documentation with supporting evidence

The key advantage: you don't need to have been using the platform during 2022-2024. The data already exists in your Git repositories and project management tools. Engineering intelligence platforms retroactively analyze this historical data.

Pensero's Approach to Section 174 Compliance

Pensero was built by engineers who understand both software development and compliance realities. The platform integrates with GitHub, GitLab, Bitbucket, Jira, Linear, GitHub Issues, Slack, Notion, Confluence, Google Calendar, Cursor, and Claude Code, without requiring developers to change how they work.

What Sets Pensero Apart

Retroactive Analysis: Because Pensero analyzes historical commit data and project records, it can document work from 2022-2024 even if you weren't using the platform back then. Your code repositories already contain the evidence; Pensero makes it visible and reportable.

Executive Summaries: Engineering data is complex. Pensero transforms raw commits, pull requests, and tickets into clear, human-readable reports that finance teams, tax advisors, and IRS auditors can actually understand. These aren't just data dumps, they're narratives explaining what your team built, why it qualified as R&D, and how time was allocated.

Built by Experts: Pensero's team has over 20 years of average experience in tech. They understand the difference between a three-line bug fix and a three-line architectural change, context that matters for R&D classification but requires engineering expertise to recognize.

Trusted by Engineering Leaders: Companies using Pensero include:

Travelperk: Travel management platform

Elfie.co: AI-powered assistant

Caravelo: Travel technology solutions

Flexible Pricing for Growing Teams

Free Tier:

A lightweight version of Pensero designed for small teams to explore the platform’s core concepts.

It does not include the granular, engineer level analysis required for Section 174 documentation, but it’s useful for understanding how automatic work attribution works in practice.

Premium:

A full one year commitment of $600 per engineer, required to process 12 months of historical data and unlock the features needed for Section 174 analysis.

This tier includes the advanced attribution, R&D classification, and documentation capabilities that tax advisors rely on.

Enterprise: Custom pricing for larger organizations with advanced compliance and integration requirements.

Practical Steps to Claim Your Refund

1. Verify Qualification (Week 1)

Calculate 3-year average revenue

Confirm US entity status and tax filing history

Verify code repositories and project records are accessible

2. Connect Your Data Sources (Week 2)

Link code repositories (GitHub, GitLab, Bitbucket)

Connect project management (Jira, Linear, GitHub Issues)

Integrate communication tools (Slack, Notion, Confluence)

For Pensero, this is a straightforward setup process that typically takes 2-3 hours.

3. Generate Historical Documentation (Weeks 3-4) The platform analyzes 2022-2024 data to produce:

Percentage of work delivered by engineer and initiative

R&D vs. operational classification

Domestic vs. foreign attribution

Supporting evidence from commits, PRs, and tickets

4. Review and Refine (Week 5) Work with the platform to:

Validate automated categorizations

Flag edge cases requiring manual review

Confirm domestic vs. foreign engineer locations

Generate preliminary reports

5. Tax Advisor Collaboration (Weeks 6-7) Provide IRS-ready documentation to your tax advisor. They'll:

Review documentation quality

Confirm qualification under current regulations

Prepare amended returns (Form 1120X)

Calculate precise refund amounts

6. File Amended Returns (Week 8) Your tax advisor files amended returns for qualifying years:

2022 returns: Due by April 2026

2023 returns: Due by April 2027

2024 returns: Due by April 2028

7. Track Refund Status (Ongoing) The IRS typically processes amended returns in 12-16 weeks. Refunds are direct-deposited to your business account.

What the Numbers Actually Look Like

10-Engineer Startup

R&D expense: $1.5M annually (10 × $150K average cost)

80% qualifying as R&D: $1.2M annually

3-year total: $3.6M

Tax overpayment at 21% rate: ~$600K

25-Engineer Growth Company

R&D expense: $3.75M annually (25 × $150K)

75% qualifying: $2.8M annually

3-year total: $8.4M

Tax overpayment: ~$1.4M

50-Engineer Established Company

R&D expense: $8M annually (50 × $160K)

70% qualifying: $5.6M annually

3-year total: $16.8M

Tax overpayment: ~$2.8M

These aren't small numbers. For a startup, a $600K refund could extend runway by 6+ months, potentially the difference between reaching profitability and shutting down.

Beyond the Refund: Long-Term Benefits

Implementing automatic work allocation for Section 174 delivers ongoing value:

Resource Planning: Understand how teams actually spend time. Which projects consume the most resources? Where are hidden time sinks? Make data-driven decisions about where to invest engineering effort.

Productivity Insights: Identify which types of work generate the most value versus create technical debt. Spot bottlenecks before they become crises.

Project Forecasting: Historical work allocation data improves future estimates. When similar work took 200 hours last time, your next estimate has real foundation.

Continuous Compliance: Once set up, automatic work allocation ensures ongoing Section 174 compliance. No scrambling at tax season, the documentation is always current.

Developer Experience: Unlike manual time tracking, automatic work allocation requires zero overhead from developers. They work normally while the platform handles documentation behind the scenes.

The Time Window Is Closing

You have three years from the original filing date to amend returns:

2022 returns: Deadline April 2026 (14 months away)

2023 returns: Deadline April 2027 (26 months away)

2024 returns: Deadline April 2028 (38 months away)

With 3-6 months required for proper documentation and filing, your real window is shorter than it appears. Companies that wait until 2026 to start will struggle to complete 2022 documentation before the deadline.

The Section 174 opportunity won't last forever. File amended returns within the window, or permanently lose the ability to claim refunds.

Take Action Now

If you qualify:

Evaluate your potential refund: Use the formulas above to estimate your 3-year overpayment

Set up engineering intelligence: Implement Pensero or similar platform to analyze historical work

Generate documentation: Produce IRS-ready reports within 4-6 weeks

Work with your tax advisor: File amended returns before deadlines

If you're unsure whether you qualify:

Calculate your 3-year average revenue precisely

Review with your tax advisor

Even if you don't qualify for retroactive relief, you benefit from immediate expensing starting 2025

The money is there. The documentation challenge is solvable. The question is whether you'll act before the window closes.

Frequently Asked Questions

Will the IRS accept automatically generated documentation?

Yes, provided it's based on objective data (commits, PRs, tickets) rather than estimates. The IRS wants reliable evidence; automatic tracking often provides better evidence than manual timesheets.

What if engineers worked overseas?

The platform separates domestic and foreign work. Foreign R&D expenses still follow 15-year amortization, so proper attribution is crucial for maximizing your refund.

Can we implement this mid-year

Yes. Automatic work allocation analyzes historical data, so you can implement today and still document work from years ago.

What about engineers who left

Their commits and PRs remain in your repositories. The platform documents their work even if they're no longer with the company.

How accurate is automated categorization

Modern platforms achieve 85-90% accuracy on R&D vs. operational classification. Edge cases are flagged for human review, ensuring high-quality results.