The Board Narrative — From signals to a story a board can use

Mini-Series: Reporting to the Board — What Every Tech Executive Should Measure (and Why)

Ivan Peralta

Engineering

Jan 17, 2026

In the first article of this series, I covered the signals tech executives are expected to answer at board level — with clarity, not dashboards.

This article is about the next step:

Turning engineering reality into a short narrative that helps the board make decisions.

Why this matters more than ever

Board expectations are shifting fast. In today’s market, credibility isn’t built on volume of reporting or operational detail. It’s built on your ability to explain what is changing, why it matters, and what decisions follow.

With tighter capital, higher customer scrutiny, and less tolerance for execution risk, boards are optimizing for signal over noise. They want to understand exposure, trade-offs, and confidence, not be walked through dashboards.

At the same time, the underlying system has become harder to reason about. Teams are larger, work is more asynchronous (or outsourced), and AI is changing productivity patterns. Outcomes are no longer explained by headcount or velocity alone.

That’s where snapshot metrics break.

What matters is trajectory: how reliability, leverage, rework, and learning speed evolve over time and whether changes are structural or incidental. Without stable, longitudinal signals, board conversations degrade into debates about numbers instead of choices about direction.

This is a framework, not a script

Before we get into structure, one important caveat: there is no single “right” board narrative. The right narrative depends on the company’s stage and the problem you’re solving right now.

For example, the emphasis changes depending on context:

PMF: prove learning speed, not process perfection.

GTM engine: prove predictability and customer readiness.

Scale the org: prove leadership capacity and sustainable onboarding.

Stabilise execution: prove reliability and recovery of delivery confidence.

Exec onboarding moments: align on what’s fragile and what changes next (we’ll cover this in a future series).

So treat what follows as a structure you adapt, not a template you blindly copy.

What boards actually optimise for

Almost every board question maps to three concerns:

Risk: what can break, and how exposed are we? Examples:

“Are we confident with the enterprise SLAs we’re signing?”

“What would cause churn in our top accounts this quarter?”

“Are we one incident away from losing momentum?”

Runway/resources: are we investing wisely, what’s the constraint, what’s the ask? Examples:

“Why are we asking for more headcount if the team is already large?”

“What’s the constraint: hiring, architecture, process, priorities?”

“If we don’t approve this investment, what slips?”

Direction: are we placing the right bets, and are we on track? Examples:

“Are we still on a credible path to product–market fit?”

“Is the platform a growth enabler or a drag on GTM?”

“What are the top bets this quarter, and what would make us change them?”

Principle: boards don’t need “all the numbers.” They need trend + context + decision.

Trend: what’s moving over time (not just a monthly snapshot)

Context: what changed, and why it matters now

Decision: what you’re doing about it, and what you need from the board (if anything)

The 3-slide framework (the whole meeting in 10 minutes)

Slide 1 — Where we are (now)

Top 3 highlights: outcomes and deltas since last board (not activity). One line each: impact + why it’s repeatable.

Top 3 risks: severity, likelihood, mitigation, owner. Call out unknowns early — it builds trust.

One trend chart: pick one — reliability or delivery predictability. Add one line: “The curve moved because…” Tie it to business exposure.

Slide 2 — What we’re doing (next)

Three strategic bets (max): outcome, why now, next milestones + dates.

Milestone health (RAG): with your rule. For amber/red: “To turn this green, we need X.”

Dependencies and asks: phrase as decisions the board can support (hiring, vendor, budget, cross-functional commitment, trade-offs).

Slide 3 — What it means (outcomes)

Expected impact: revenue, churn, cost-to-serve, risk reduction. Use ranges when needed.

Time horizon + success criteria: Q / H1 / FY, with 1–2 measurable success statements per bet.

Confidence (optional): High/Medium/Low + why, and what would change it (leading indicator).

Mechanics that make it land (and what breaks it)

The rules of executive storytelling:

Trend > snapshot — one month can be luck. The direction is signal.

Context > numbers — always answer: why did it move?

Deltas > totals — “what changed since last time” is what matters.

Decisions > updates — a board meeting is for choices, not narration.

Translate engineering into business language. Examples:

“MTTR down 35% → fewer escalations → lower SLA credit/churn risk.”

“Cycle time down 20% → faster GTM iteration → higher conversion velocity.”

“Rework up → less capacity for roadmap → delivery risk for Q commitments.”

Pitfalls and patterns that keep board updates useful:

Vanity metrics and the “wall of charts”: If a chart doesn’t drive a decision, remove it. One strong trend beats twelve weak ones.

Over-precision and false certainty: Use ranges. State assumptions. Precision theatre destroys trust when reality shifts.

Burying the ask until the last minute: If you need a decision, say it on Slide 1 or Slide 2. Boards hate surprises at minute 55.

Mixing strategy and operations in the same sentence: Keep the separation clean: Strategy = bets and outcomes. Operations = reliability, delivery, capacity, risk.

Reporting activity instead of trajectory: “We shipped X” is not a board update. “The curve moved because X, and here’s what we’ll do next” is.

How Pensero helps

TODO: PENDING SOME PENSERO IMAGES

If you adopt the three-slide structure, the hardest part is not writing slides — it’s keeping the inputs consistent month over month.

Pensero helps by turning scattered engineering activity into a small set of board-usable signals, and keeping them stable over time:

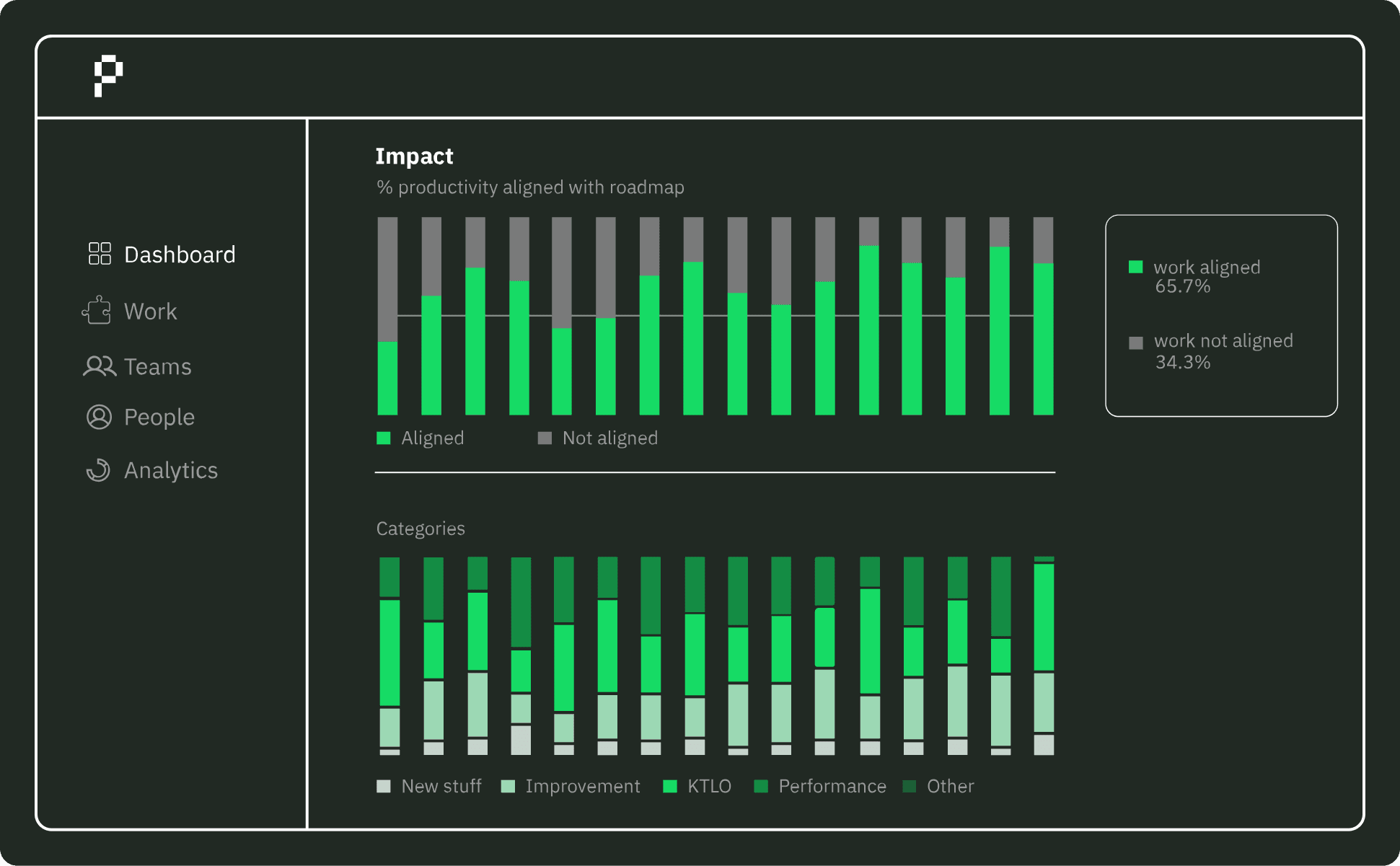

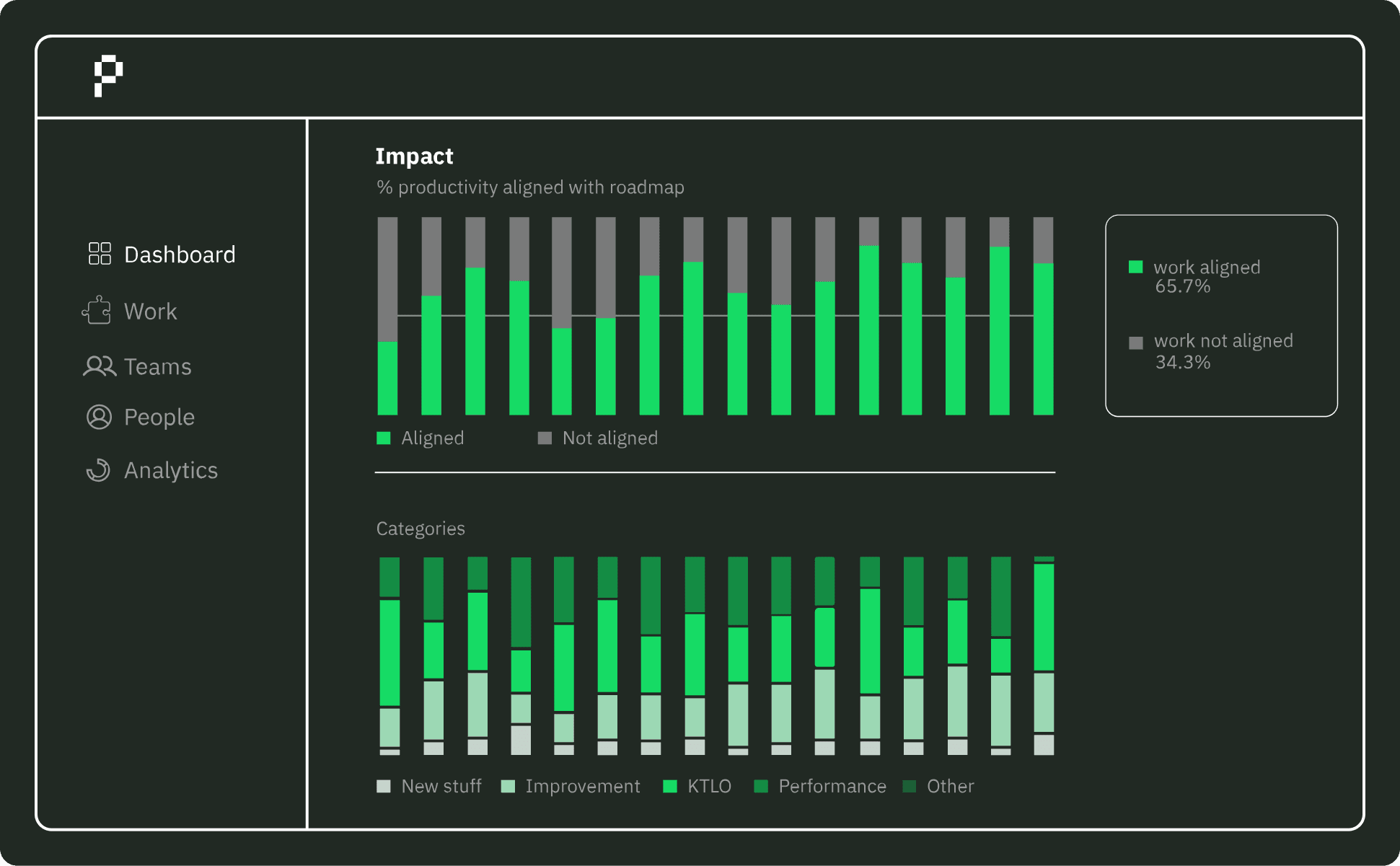

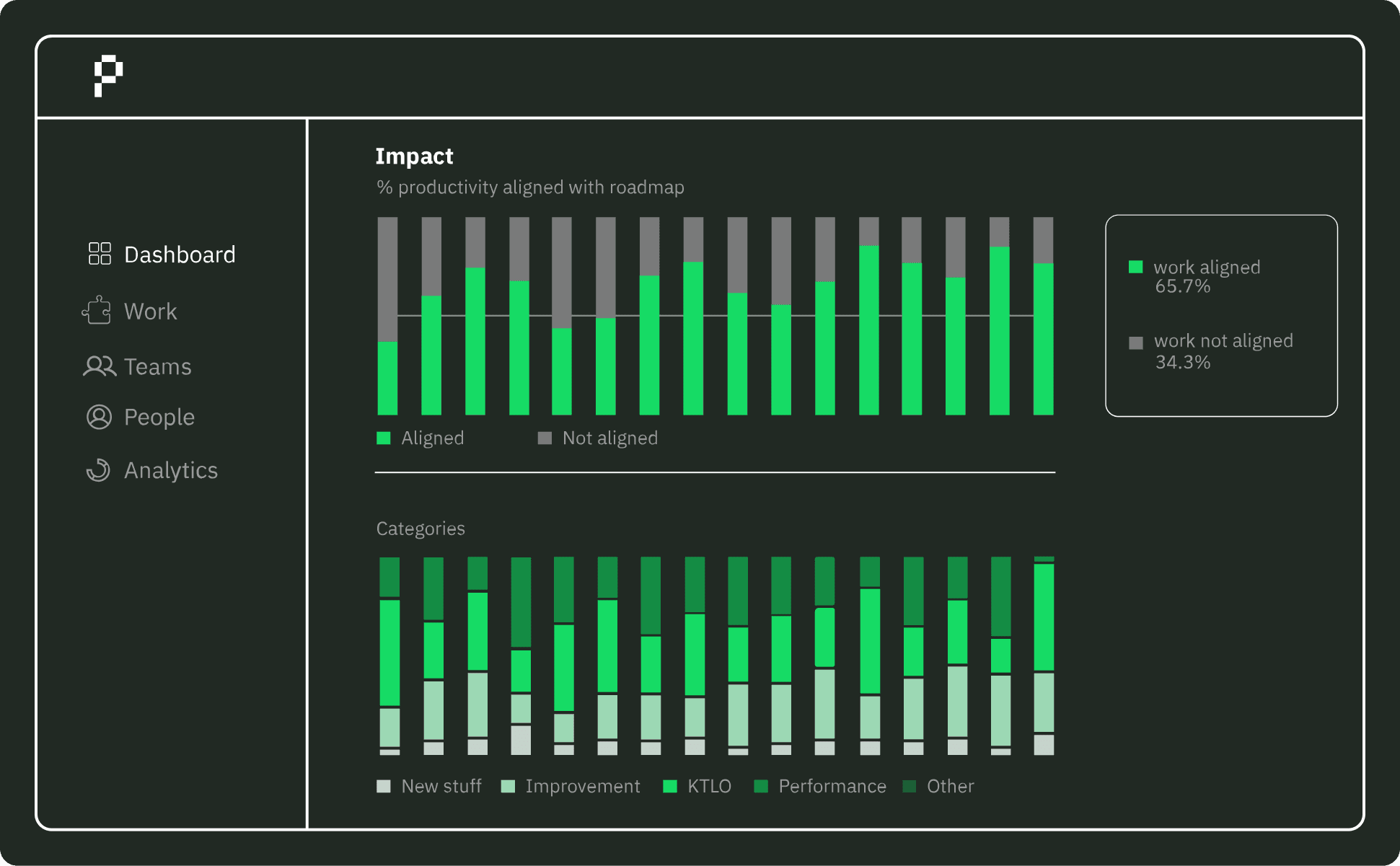

Slide 1: “Pulse” trends: A composite view of the few trends boards actually care about: leverage, productivity, rework/quality, and learning speed — so you can show trajectory, not a dashboard dump.

Below is an example of the kind of signal that works at board level: a single view showing how engineering effort aligns with the roadmap and how that alignment evolves over time. The focus is on trajectory and exposure, not activity.

Slide 2: Strategic bets mapped to real work: Automatic effort-to-initiative mapping (repos + tickets + docs) to show whether teams are actually investing in the agreed bets, and how each bet is progressing over time.

Slide 3: Outcomes and exposure: Reliability and quality signals translated into business impact proxies (risk, cost-to-serve, churn exposure), so the conversation stays in business language.

The point is simple: less manual reporting, fewer debates about “which numbers are real”, and more time spent on decisions.

Closing

A strong board narrative is not a performance. It’s a discipline: show where you are, what’s changing, what you’re doing next, and what it means — consistently, month after month.

Ultimately, it’s not about persuasion or polish. It’s about consistency: showing the same few signals, framed the same way, is what builds trust and enables real decisions.

When engineering reality is legible at the board level — without translation overhead or metric debates — leadership can focus on trade-offs, direction, and timing.

In this environment, clarity compounds: fewer slides, fewer surprises, and better decisions over time.

In the first article of this series, I covered the signals tech executives are expected to answer at board level — with clarity, not dashboards.

This article is about the next step:

Turning engineering reality into a short narrative that helps the board make decisions.

Why this matters more than ever

Board expectations are shifting fast. In today’s market, credibility isn’t built on volume of reporting or operational detail. It’s built on your ability to explain what is changing, why it matters, and what decisions follow.

With tighter capital, higher customer scrutiny, and less tolerance for execution risk, boards are optimizing for signal over noise. They want to understand exposure, trade-offs, and confidence, not be walked through dashboards.

At the same time, the underlying system has become harder to reason about. Teams are larger, work is more asynchronous (or outsourced), and AI is changing productivity patterns. Outcomes are no longer explained by headcount or velocity alone.

That’s where snapshot metrics break.

What matters is trajectory: how reliability, leverage, rework, and learning speed evolve over time and whether changes are structural or incidental. Without stable, longitudinal signals, board conversations degrade into debates about numbers instead of choices about direction.

This is a framework, not a script

Before we get into structure, one important caveat: there is no single “right” board narrative. The right narrative depends on the company’s stage and the problem you’re solving right now.

For example, the emphasis changes depending on context:

PMF: prove learning speed, not process perfection.

GTM engine: prove predictability and customer readiness.

Scale the org: prove leadership capacity and sustainable onboarding.

Stabilise execution: prove reliability and recovery of delivery confidence.

Exec onboarding moments: align on what’s fragile and what changes next (we’ll cover this in a future series).

So treat what follows as a structure you adapt, not a template you blindly copy.

What boards actually optimise for

Almost every board question maps to three concerns:

Risk: what can break, and how exposed are we? Examples:

“Are we confident with the enterprise SLAs we’re signing?”

“What would cause churn in our top accounts this quarter?”

“Are we one incident away from losing momentum?”

Runway/resources: are we investing wisely, what’s the constraint, what’s the ask? Examples:

“Why are we asking for more headcount if the team is already large?”

“What’s the constraint: hiring, architecture, process, priorities?”

“If we don’t approve this investment, what slips?”

Direction: are we placing the right bets, and are we on track? Examples:

“Are we still on a credible path to product–market fit?”

“Is the platform a growth enabler or a drag on GTM?”

“What are the top bets this quarter, and what would make us change them?”

Principle: boards don’t need “all the numbers.” They need trend + context + decision.

Trend: what’s moving over time (not just a monthly snapshot)

Context: what changed, and why it matters now

Decision: what you’re doing about it, and what you need from the board (if anything)

The 3-slide framework (the whole meeting in 10 minutes)

Slide 1 — Where we are (now)

Top 3 highlights: outcomes and deltas since last board (not activity). One line each: impact + why it’s repeatable.

Top 3 risks: severity, likelihood, mitigation, owner. Call out unknowns early — it builds trust.

One trend chart: pick one — reliability or delivery predictability. Add one line: “The curve moved because…” Tie it to business exposure.

Slide 2 — What we’re doing (next)

Three strategic bets (max): outcome, why now, next milestones + dates.

Milestone health (RAG): with your rule. For amber/red: “To turn this green, we need X.”

Dependencies and asks: phrase as decisions the board can support (hiring, vendor, budget, cross-functional commitment, trade-offs).

Slide 3 — What it means (outcomes)

Expected impact: revenue, churn, cost-to-serve, risk reduction. Use ranges when needed.

Time horizon + success criteria: Q / H1 / FY, with 1–2 measurable success statements per bet.

Confidence (optional): High/Medium/Low + why, and what would change it (leading indicator).

Mechanics that make it land (and what breaks it)

The rules of executive storytelling:

Trend > snapshot — one month can be luck. The direction is signal.

Context > numbers — always answer: why did it move?

Deltas > totals — “what changed since last time” is what matters.

Decisions > updates — a board meeting is for choices, not narration.

Translate engineering into business language. Examples:

“MTTR down 35% → fewer escalations → lower SLA credit/churn risk.”

“Cycle time down 20% → faster GTM iteration → higher conversion velocity.”

“Rework up → less capacity for roadmap → delivery risk for Q commitments.”

Pitfalls and patterns that keep board updates useful:

Vanity metrics and the “wall of charts”: If a chart doesn’t drive a decision, remove it. One strong trend beats twelve weak ones.

Over-precision and false certainty: Use ranges. State assumptions. Precision theatre destroys trust when reality shifts.

Burying the ask until the last minute: If you need a decision, say it on Slide 1 or Slide 2. Boards hate surprises at minute 55.

Mixing strategy and operations in the same sentence: Keep the separation clean: Strategy = bets and outcomes. Operations = reliability, delivery, capacity, risk.

Reporting activity instead of trajectory: “We shipped X” is not a board update. “The curve moved because X, and here’s what we’ll do next” is.

How Pensero helps

TODO: PENDING SOME PENSERO IMAGES

If you adopt the three-slide structure, the hardest part is not writing slides — it’s keeping the inputs consistent month over month.

Pensero helps by turning scattered engineering activity into a small set of board-usable signals, and keeping them stable over time:

Slide 1: “Pulse” trends: A composite view of the few trends boards actually care about: leverage, productivity, rework/quality, and learning speed — so you can show trajectory, not a dashboard dump.

Below is an example of the kind of signal that works at board level: a single view showing how engineering effort aligns with the roadmap and how that alignment evolves over time. The focus is on trajectory and exposure, not activity.

Slide 2: Strategic bets mapped to real work: Automatic effort-to-initiative mapping (repos + tickets + docs) to show whether teams are actually investing in the agreed bets, and how each bet is progressing over time.

Slide 3: Outcomes and exposure: Reliability and quality signals translated into business impact proxies (risk, cost-to-serve, churn exposure), so the conversation stays in business language.

The point is simple: less manual reporting, fewer debates about “which numbers are real”, and more time spent on decisions.

Closing

A strong board narrative is not a performance. It’s a discipline: show where you are, what’s changing, what you’re doing next, and what it means — consistently, month after month.

Ultimately, it’s not about persuasion or polish. It’s about consistency: showing the same few signals, framed the same way, is what builds trust and enables real decisions.

When engineering reality is legible at the board level — without translation overhead or metric debates — leadership can focus on trade-offs, direction, and timing.

In this environment, clarity compounds: fewer slides, fewer surprises, and better decisions over time.

In the first article of this series, I covered the signals tech executives are expected to answer at board level — with clarity, not dashboards.

This article is about the next step:

Turning engineering reality into a short narrative that helps the board make decisions.

Why this matters more than ever

Board expectations are shifting fast. In today’s market, credibility isn’t built on volume of reporting or operational detail. It’s built on your ability to explain what is changing, why it matters, and what decisions follow.

With tighter capital, higher customer scrutiny, and less tolerance for execution risk, boards are optimizing for signal over noise. They want to understand exposure, trade-offs, and confidence, not be walked through dashboards.

At the same time, the underlying system has become harder to reason about. Teams are larger, work is more asynchronous (or outsourced), and AI is changing productivity patterns. Outcomes are no longer explained by headcount or velocity alone.

That’s where snapshot metrics break.

What matters is trajectory: how reliability, leverage, rework, and learning speed evolve over time and whether changes are structural or incidental. Without stable, longitudinal signals, board conversations degrade into debates about numbers instead of choices about direction.

This is a framework, not a script

Before we get into structure, one important caveat: there is no single “right” board narrative. The right narrative depends on the company’s stage and the problem you’re solving right now.

For example, the emphasis changes depending on context:

PMF: prove learning speed, not process perfection.

GTM engine: prove predictability and customer readiness.

Scale the org: prove leadership capacity and sustainable onboarding.

Stabilise execution: prove reliability and recovery of delivery confidence.

Exec onboarding moments: align on what’s fragile and what changes next (we’ll cover this in a future series).

So treat what follows as a structure you adapt, not a template you blindly copy.

What boards actually optimise for

Almost every board question maps to three concerns:

Risk: what can break, and how exposed are we? Examples:

“Are we confident with the enterprise SLAs we’re signing?”

“What would cause churn in our top accounts this quarter?”

“Are we one incident away from losing momentum?”

Runway/resources: are we investing wisely, what’s the constraint, what’s the ask? Examples:

“Why are we asking for more headcount if the team is already large?”

“What’s the constraint: hiring, architecture, process, priorities?”

“If we don’t approve this investment, what slips?”

Direction: are we placing the right bets, and are we on track? Examples:

“Are we still on a credible path to product–market fit?”

“Is the platform a growth enabler or a drag on GTM?”

“What are the top bets this quarter, and what would make us change them?”

Principle: boards don’t need “all the numbers.” They need trend + context + decision.

Trend: what’s moving over time (not just a monthly snapshot)

Context: what changed, and why it matters now

Decision: what you’re doing about it, and what you need from the board (if anything)

The 3-slide framework (the whole meeting in 10 minutes)

Slide 1 — Where we are (now)

Top 3 highlights: outcomes and deltas since last board (not activity). One line each: impact + why it’s repeatable.

Top 3 risks: severity, likelihood, mitigation, owner. Call out unknowns early — it builds trust.

One trend chart: pick one — reliability or delivery predictability. Add one line: “The curve moved because…” Tie it to business exposure.

Slide 2 — What we’re doing (next)

Three strategic bets (max): outcome, why now, next milestones + dates.

Milestone health (RAG): with your rule. For amber/red: “To turn this green, we need X.”

Dependencies and asks: phrase as decisions the board can support (hiring, vendor, budget, cross-functional commitment, trade-offs).

Slide 3 — What it means (outcomes)

Expected impact: revenue, churn, cost-to-serve, risk reduction. Use ranges when needed.

Time horizon + success criteria: Q / H1 / FY, with 1–2 measurable success statements per bet.

Confidence (optional): High/Medium/Low + why, and what would change it (leading indicator).

Mechanics that make it land (and what breaks it)

The rules of executive storytelling:

Trend > snapshot — one month can be luck. The direction is signal.

Context > numbers — always answer: why did it move?

Deltas > totals — “what changed since last time” is what matters.

Decisions > updates — a board meeting is for choices, not narration.

Translate engineering into business language. Examples:

“MTTR down 35% → fewer escalations → lower SLA credit/churn risk.”

“Cycle time down 20% → faster GTM iteration → higher conversion velocity.”

“Rework up → less capacity for roadmap → delivery risk for Q commitments.”

Pitfalls and patterns that keep board updates useful:

Vanity metrics and the “wall of charts”: If a chart doesn’t drive a decision, remove it. One strong trend beats twelve weak ones.

Over-precision and false certainty: Use ranges. State assumptions. Precision theatre destroys trust when reality shifts.

Burying the ask until the last minute: If you need a decision, say it on Slide 1 or Slide 2. Boards hate surprises at minute 55.

Mixing strategy and operations in the same sentence: Keep the separation clean: Strategy = bets and outcomes. Operations = reliability, delivery, capacity, risk.

Reporting activity instead of trajectory: “We shipped X” is not a board update. “The curve moved because X, and here’s what we’ll do next” is.

How Pensero helps

TODO: PENDING SOME PENSERO IMAGES

If you adopt the three-slide structure, the hardest part is not writing slides — it’s keeping the inputs consistent month over month.

Pensero helps by turning scattered engineering activity into a small set of board-usable signals, and keeping them stable over time:

Slide 1: “Pulse” trends: A composite view of the few trends boards actually care about: leverage, productivity, rework/quality, and learning speed — so you can show trajectory, not a dashboard dump.

Below is an example of the kind of signal that works at board level: a single view showing how engineering effort aligns with the roadmap and how that alignment evolves over time. The focus is on trajectory and exposure, not activity.

Slide 2: Strategic bets mapped to real work: Automatic effort-to-initiative mapping (repos + tickets + docs) to show whether teams are actually investing in the agreed bets, and how each bet is progressing over time.

Slide 3: Outcomes and exposure: Reliability and quality signals translated into business impact proxies (risk, cost-to-serve, churn exposure), so the conversation stays in business language.

The point is simple: less manual reporting, fewer debates about “which numbers are real”, and more time spent on decisions.

Closing

A strong board narrative is not a performance. It’s a discipline: show where you are, what’s changing, what you’re doing next, and what it means — consistently, month after month.

Ultimately, it’s not about persuasion or polish. It’s about consistency: showing the same few signals, framed the same way, is what builds trust and enables real decisions.

When engineering reality is legible at the board level — without translation overhead or metric debates — leadership can focus on trade-offs, direction, and timing.

In this environment, clarity compounds: fewer slides, fewer surprises, and better decisions over time.